Dosing Systems Market: Industry Outlook

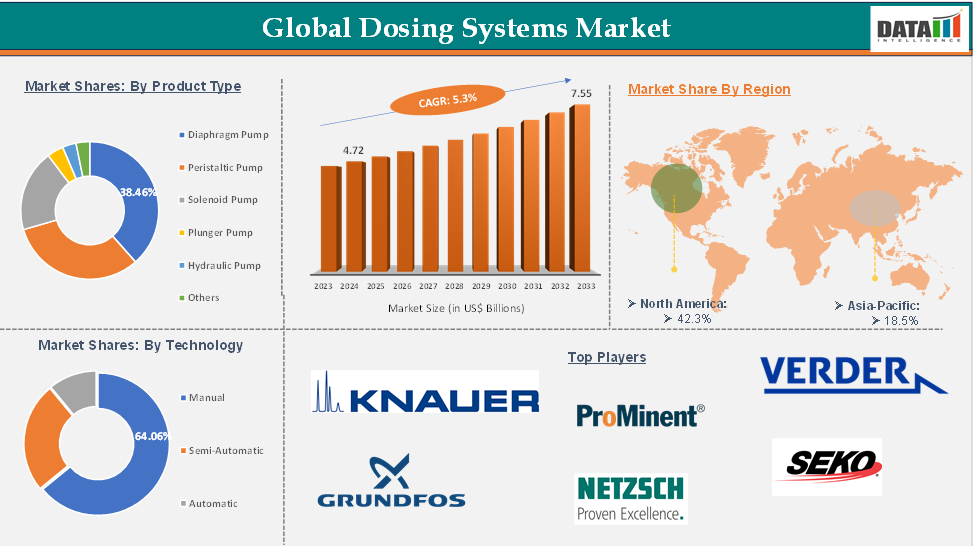

Dosing Systems Market reached US$ 4.72 Billion in 2024 and is expected to reach US$ 7.55 Billion by 2033, growing at a CAGR of 5.3% during the forecast period 2025-2033.

The global dosing systems market is growing due to increasing demand across industries like water and wastewater treatment, pharmaceuticals, chemicals, and food and beverages. Advanced technologies are being adopted to ensure precise and efficient dosing solutions.

Water and wastewater treatment is the dominant application, with investments in sewage treatment infrastructure in countries like India and China boosting demand. Automated and smart dosing technologies are enhancing operational efficiency and product quality in pharmaceutical and chemical processing. The food and beverage sector is also adopting dosing systems to ensure product consistency and safety standards.

Executive Summary

For more details on this report, Request for Sample

Dosing Systems Market Dynamics: Drivers & Restraints

Driver: Increase in technological advancements

Technological advancements, including automation, smart sensors, and IoT integration, have significantly improved the precision, efficiency, and reliability of dosing systems. These systems now offer real-time monitoring, remote operation, and data analysis, reducing human intervention. AI and machine learning predict maintenance needs and improve dosing accuracy.

Energy-efficient and eco-friendly systems address sustainability concerns, making them attractive to industries like water treatment, pharmaceuticals, food and beverages, and chemicals. These developments have led to widespread adoption across various sectors, fueling the global dosing systems market growth.

For instance, in April 2024, Baxter International received FDA 510(k) clearance for its Novum IQ large volume infusion pump (LVP) with Dose IQ Safety Software. This addition to the Novum IQ Infusion Platform, which includes Baxter's syringe infusion pump (SYR) with Dose IQ Safety Software, allows clinicians to use a single, integrated system across various patient care settings. Baxter's commitment to innovation in infusion therapy is demonstrated by offering the Novum IQ LVP in the U.S.

Restraint: Complexity of the systems

The global dosing systems market faces challenges in system integration and maintenance due to the complexity of these systems. Integrating dosing systems into existing industrial processes can be difficult, especially in older infrastructure that doesn't support modern technologies. Aligning dosing systems with other automated equipment can cause delays or operational inefficiencies.

Additionally, maintaining dosing systems requires skilled personnel for troubleshooting, which can be a constraint for organizations with limited technical expertise. These challenges may discourage SMEs from adopting advanced dosing systems, potentially hindering market growth.

Dosing Systems Market Segment Analysis

The global Dosing Systems market is segmented based on product type, technology, end user, and region.

Product Type:

The pharmaceuticals segment of the product type is expected to hold 38.46% of the dosing systems market

The pharmaceutical industry is driving the global dosing systems market growth due to its importance in precision and accuracy in drug manufacturing and formulation processes. These systems measure and deliver active pharmaceutical ingredients, excipients, and other critical components, ensuring product consistency, safety, and regulatory compliance. They enable automated and contamination-free dosing, maintaining quality in sterile environments. With the growing demand for personalized medicine, biopharmaceuticals, and high-potency drugs, advanced dosing systems equipped with smart technologies and automation are being adopted to improve efficiency and reduce human error. The pharmaceutical sector is a key end-user segment in the global dosing systems market.

For instance, in 2024, High Purity New England launched the VerderFlex Vantage 5000 Peristaltic Pump from Verder Inc., a leading supplier of biopharma solutions. The pump is ideal for low to medium flow and low to medium pressures in biopharmaceutical technologies. It features precise, repeatable dosing and advanced record-keeping and control options, with a high-resolution 4000:1 turndown drive, making it suitable for demanding bioprocessing technologies. HPNE plans to expand its pump offerings.

Dosing Systems Market Geographical Analysis

North America dominated the global dosing systems market with the highest share of 42.3% in 2024

North America holds a substantial position in the dosing systems market and is expected to hold most of the market share due to its advanced industrial infrastructure, economic growth, and high adoption of automation technologies.

The region's water and wastewater treatment sector and pharmaceutical industry, particularly in the US, drive demand for precision dosing in drug manufacturing and formulation processes. Technological advancements like IoT integration, real-time monitoring, and data analytics enhance market adoption by improving efficiency and minimizing human intervention.

For instance, in August 2024, Dürr introduced the EcoMeter SP, a continuous dosing system designed for the seamless Technology of highly viscous media without disrupting material flow. This lightweight, compact, and cost-effective system is ideal for large-volume technology requiring substantial amounts of adhesives or sealants, powered by a screw spindle pump.

Dosing Systems Market Key Players

The major global players in the dosing systems market include KNAUER Wissenschaftliche Geräte GmbH, ProMinent, Verder Liquid B.V, Seko, Watson-Marlow Fluid Technology Solutions, Grundfos, Netzsch Pumps, Nikkiso Co. Ltd, SPX Flow, Blue White Pumps and among others.

Industry Key Developments

- In April 2024, Brightwell, a global leader in chemical dilution and dosing systems, launched Nexus, a smart laundry dosing system designed to revolutionize commercial laundry operations through remote monitoring.

Market Scope

Metrics | Details | |

CAGR | 5.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Diaphragm Pump, Peristaltic Pump, Solenoid Pump, Plunger Pump, Hydraulic Pump, Others |

Technology | Manual, Semi-Automatic, Automatic | |

End User | Pharmaceuticals, Oil and Gas, Water and Wastewater Chemicals, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |