Flexible Endoscopy Market Size

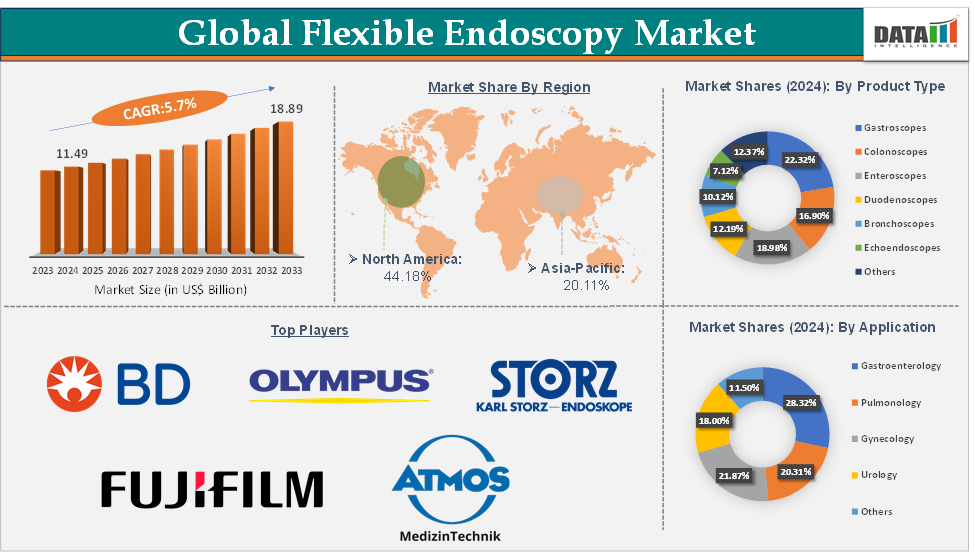

The global flexible endoscopy market size reached US$ 11.49 Billion in 2024 and is expected to reach US$ 18.89 Billion by 2033, growing at a CAGR of 5.7% during the forecast period 2025-2033.

Flexible Endoscopy Market Overview

The global flexible endoscopy market is experiencing significant growth, driven by technological advancements, increasing demand for minimally invasive procedures, and rising prevalence of chronic diseases. This market encompasses flexible endoscopes used for diagnostic and therapeutic procedures across various medical specialties, including gastroenterology, pulmonology, urology, and gynecology. Major companies in the market include Olympus Corporation, which contributes significantly to the global endoscope market. Other notable players are focusing on disposable endoscopes to mitigate cross-contamination risks.

Flexible Endoscopy Market Executive Summary

Flexible Endoscopy Market Dynamics: Drivers & Restraints

Growing preference for minimally invasive procedures is significantly driving the flexible endoscopy market growth

Minimally invasive procedures have become increasingly popular in healthcare due to their numerous benefits over traditional open surgeries, such as reduced patient trauma, faster recovery times, lower risk of complications, and shorter hospital stays. Flexible endoscopy perfectly aligns with this trend because it allows physicians to visually inspect, diagnose, and treat internal organs through small natural openings or tiny incisions using highly flexible instruments.

Flexible endoscopes enable procedures like colonoscopies and bronchoscopies without large incisions. Flexible endoscopes are used not just for diagnosis but also for treatments like polyp removal, stent placement, or biopsy sampling, reducing the need for multiple invasive surgeries. For instance, endoscopic retrograde cholangiopancreatography (ERCP) treats bile duct obstructions minimally invasively.

Minimally invasive flexible endoscopic procedures often require shorter hospital stays and less post-operative care, reducing overall treatment costs, appealing to both patients and healthcare systems. As patients become more aware of the benefits, demand for minimally invasive diagnostics and treatments grows, pushing hospitals to invest in flexible endoscopy technologies. Companies like Olympus and Pentax have developed ultra-thin, highly maneuverable flexible endoscopes with enhanced imaging, making minimally invasive procedures more effective and accessible.

The risk of cross-contamination and infection is hampering the growth of the market

Flexible endoscopes are reusable medical devices that come into direct contact with internal tissues and bodily fluids during procedures. Despite strict cleaning and sterilization protocols, there remains a significant risk of cross-contamination and infection transmission between patients if the endoscopes are not properly reprocessed.

Flexible endoscopes have intricate channels and narrow lumens that make thorough cleaning difficult. Even after reprocessing, residual bacteria or pathogens can persist. For example, outbreaks of infections caused by multidrug-resistant organisms linked to contaminated duodenoscopes (a type of flexible endoscope) have been reported worldwide.

Cases of infections such as carbapenem-resistant Enterobacteriaceae (CRE) outbreaks related to duodenoscope use in hospitals have raised concerns about patient safety, leading to regulatory scrutiny and hesitancy in adopting flexible endoscopy in some settings. The need for labor-intensive, time-consuming, and expensive sterilization processes increases operational costs for healthcare providers, limiting flexible endoscope use in cost-sensitive facilities.

For more details on this report – Request for Sample

Flexible Endoscopy Market, Segment Analysis

The global flexible endoscopy market is segmented based on product type, application, end-user, and region.

Gastroenterology from the application segment is expected to hold 28.32% of the market share in 2024 in the flexible endoscopy market

Procedures like colonoscopy, gastroscopy (upper GI endoscopy), and endoscopic retrograde cholangiopancreatography (ERCP) are widely performed to detect and manage conditions such as colorectal cancer, ulcers, polyps, and bile duct obstructions. For instance, colonoscopy is a gold-standard screening tool for colorectal cancer, which is among the most common cancers globally.

Gastrointestinal disorders, including colorectal cancer, irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), and inflammatory bowel disease (IBD) are widespread globally. Flexible endoscopy plays a crucial role in diagnosing and managing these conditions, making gastroenterology the largest segment in the market.

For instance, according to the World Gastroenterology Organisation, while GI diseases remained very common (incidence 7.3 billion cases - largely due to enteric infections) and important (8 million deaths – cirrhosis a major factor), prevalence remained stable. Overall, 49% of females and 36.6% of males met the criteria for at least one functional gastrointestinal disorder - the most common disorders in all regions being functional constipation, functional dyspepsia, proctalgia fugax, functional diarrhea and IBS at prevalence rates of 11.7%, 7.2%, 5.9%, 4.7% and 4.1, respectively. These rising prevalences are boosting the demand for the flexible endoscopy market.

Flexible Endoscopy Market, Geographical Analysis

North America is expected to dominate the global flexible endoscopy market with a 44.18% share in 2024

Major players such as Olympus, Boston Scientific, and FUJIFILM are headquartered or maintain significant operations in North America, along with many emerging market players, focusing on the development of flexible endoscopes. Additionally, their proximity to leading academic medical centers accelerates clinical validation and adoption of innovations like 4K imaging, AI-assisted lesion detection, and disposable endoscopes.

For instance, in May 2024, Vivo Surgical soft-launched the ENLYT Flexible Endoscope at the global health conference "Promoting Healthier Connections with the World." The ENLYT flexible endoscope is a reusable and portable system for screening and imaging applications. ENLYT is developed in collaboration with Duke Health (USA) with initial R&D funding from the US National Institutes of Health. The device is intended for visualization of the upper airway from the nasal passage to the larynx.

Asia-Pacific is growing at the fastest pace in the flexible endoscopy market, holding 20.11% of the market share

Governments across China, India, and Southeast Asia are heavily investing in new hospitals and outpatient endoscopy centers. For instance, China’s “Healthy China 2030” plan has spurred the construction of thousands of tier-2 and tier-3 hospitals, many of which are now equipping dedicated endoscopy suites to address the rising GI disease burden. Nations such as Thailand and Malaysia are positioning themselves as medical-tourism hubs by offering high-quality, cost-competitive endoscopic procedures. International patients flock to leading private hospitals, boosting regional procedure volumes.

Flexible Endoscopy Market Competitive Landscape

Top companies in the flexible endoscopy market include BD, KARL STORZ, Olympus Corporation, FUJIFILM Holdings Corporation, Boston Scientific Corporation, Richard Wolf GmbH, ATMOS MedizinTechnik GmbH & Co. KG, LABORIE MEDICAL TECHNOLOGIES CORP., EndoMed Systems GmbH, and Entermed, among others.

Flexible Endoscopy Market Scope

Metrics | Details | |

CAGR | 5.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Gastroscopes, Colonoscopes, Enteroscopes, Duodenoscopes, Bronchoscopes, Echoendoscopes, Others |

Application | Gastroenterology, Pulmonology, Gynecology, Urology, Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global flexible endoscopy market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 166 pages of expert insights, providing a complete view of the market landscape.