E-Fuel Market Size

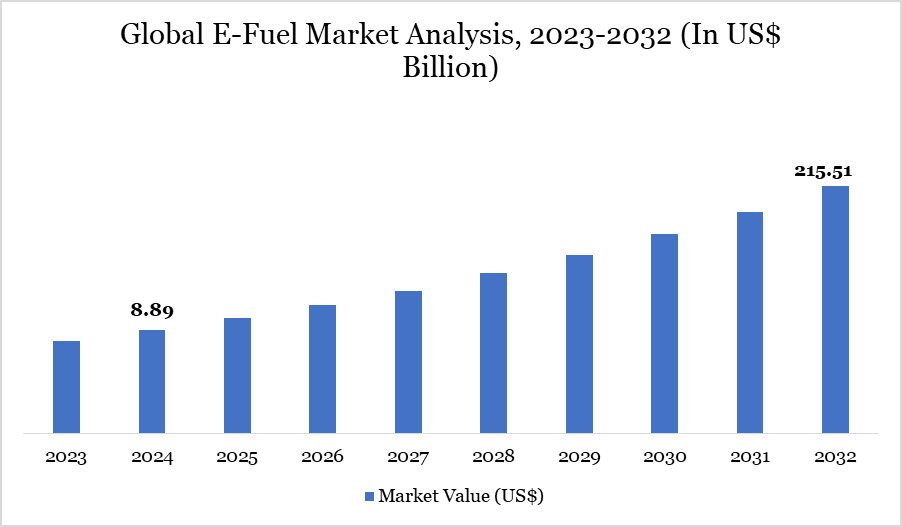

Global E-fuel market size reached US$ 8.89 billion in 2024 and is expected to reach US$ 215.51 billion by 2032, growing with a CAGR of 48.96% during the forecast period 2025-2032.

E-fuels, synthetic fuels made from hydrogen and carbon atoms, are increasingly recognized as a viable substitute for traditional fossil fuels. These fuels are generated utilizing electricity, frequently sourced from renewable energies such as wind and solar, by amalgamating carbon dioxide extracted from the atmosphere with water to make hydrocarbons like methane or syngas. Their primary advantage is compatibility with current internal combustion engines, facilitating a shift without significant infrastructure modification.

As worldwide attention on decarbonization intensifies, particularly in transportation, e-fuels present a feasible solution for reducing emissions. The IEA reports that transport fuel demand is robust, with oil consumption projected to attain 102 mb/d by 2030, necessitating the development of cleaner alternatives. Their significance is emphasized as light vehicles account for roughly 25% of world oil consumption and 10% of CO₂ emissions (2022). Thus, governmental regulations, technical advancements, and industrial partnerships are together promoting the expansion of the worldwide e-fuels market.

E-Fuel Market Trend

The e-fuels business is experiencing substantial growth, propelled by environmental regulations and collaborations between the public and commercial sectors. A significant trend is the adoption of carbon reduction laws, like the US Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS), promoting the incorporation of e-fuels into the fuel mix. Likewise, the European Union's Renewable Energy Directive (RED) and Fit-for-55 package have expedited decarbonization objectives, mandating that all new vehicles sold after 2035 to be carbon-neutral.

Technological innovation is influencing the market, exemplified by initiatives from Siemens Energy and Porsche AG in Germany, as well as the Norsk E-fuel facility in Norway, which is set to begin production by 2026. Furthermore, international collaboration is increasing—INERATEC GmbH (Germany) and Chiyoda Corporation (Japan) have partnered to advance electro-fuel initiatives in Asia. Investment in public infrastructure, awareness initiatives, and the anticipated increase in electric vehicle sales by 8–10% in 2024 underscore the critical importance of the e-fuel sector in the worldwide energy transition.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By State | Liquid, Gas |

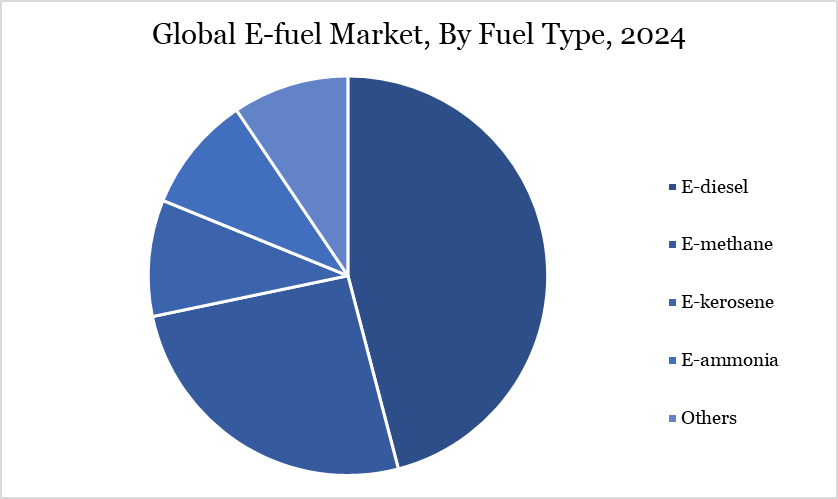

| By Fuel Type | E-diesel, E-methane, E-kerosene, E-ammonia, Others |

| By Application | Automotive, Marine, Industrial, Aviation, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

E-Fuel Market Dynamics

Regulatory Endorsement Propels Market Growth

A key catalyst for the e-fuels market's expansion is substantial governmental backing intended to diminish reliance on fossil fuels and decrease greenhouse gas emissions. Numerous countries have implemented financial incentives, requirements, and infrastructural investments to facilitate the adoption of e-fuels.

The European Union has committed €14 billion to e-fuel development by 2030. Likewise, the US has designated US$100 million for research and development, Japan provides production subsidies, and China intends to manufacture 100 million tons of e-fuels per year by 2060. These measures are essential for closing the cost disparity between e-fuels and conventional fuels, hence enhancing the commercial viability of the former.

Public awareness initiatives and legislative requirements, such as mandates for a specified amount of renewable content in fuels, additionally enhance demand. Investments in infrastructure to enhance production and delivery also facilitate market expansion. Collectively, these advantageous policy frameworks are not only expediting commercialization but also guaranteeing the long-term scalability of e-fuels.

Capital Intensity Hinders Market Penetration

Developing e-fuel production infrastructure, encompassing renewable energy sources, carbon capture, and synthetic conversion units, requires significant investment. The nascent nature of the technology also results in elevated costs due to restricted economies of scale. Renewable energy systems, including solar and wind power installations, constitute a significant cost factor, as do nascent electrolysis and fuel synthesis technologies. This capital intensity constitutes an obstacle for new entrants and hinders the expansion of existing competitors, therefore limiting market scalability.

Furthermore, extensive production is crucial for attaining efficiency and competitiveness, hence increasing the cost load. In the absence of ongoing and significant government assistance, encompassing grants, loans, and subsidies, the general adoption may be postponed. The existing cost disparity between e-fuels and fossil fuels is a significant obstacle, hindering market penetration despite increasing demand and advantageous regulatory conditions.

E-Fuel Market Segment Analysis

The global E-fuel market is segmented based on state, fuel type, application and region.

E-kerosene: The Future of Sustainable Aviation Fuel and Its Role in Decarbonizing the Industry

E-kerosene, referred to as synthetic kerosene or e-fuel, stands as the preeminent fuel type in the e-fuels sector, especially in aviation, owing to its capacity to markedly diminish carbon emissions. E-kerosene, as a leading low-emission alternative, commands a significant market share and is a pivotal emphasis in light of stringent global climate objectives, notably the EU's aim for a 35% reduction in emissions by 2050.

In contrast to conventional jet fuel, e-kerosene generates reduced levels of particles and aromatic chemicals, thereby diminishing soot and contrail formation, both of which exacerbate climate warming. This ecological advantage positions it as a pivotal factor in the decarbonization of the aviation industry.

Supported by the International Energy Agency (IEA), e-kerosene is anticipated to achieve cost competitiveness with biomass-derived Sustainable Aviation Fuel (SAF) by the end of the decade due to advancements in electrolyzer technology and design efficiency. These improvements establish e-kerosene as a pivotal and profitable sector in the future of e-fuels.

E-Fuel Market Geographical Share

Europe Ascends as the Hub of E-Fuel Innovation

Europe is anticipated to dominate the global e-fuels market from 2024 to 2035, propelled by strong legislative frameworks and significant technical expenditures. Countries such as Germany and Norway lead the way, bolstered by public policy and private entrepreneurship. Prominent participants comprise Audi AG, Siemens Energy, Sunfire GmbH, and Norsk E-fuel.

The latter is constructing a substantial facility in Mosjøen, Norway, scheduled to commence operations in late 2026 for the production of sustainable aviation fuel with CO₂ and green hydrogen. In 2023, Nordic Electrofuel secured a €40 million grant from the EU Innovation Fund to construct a commercial e-fuel facility in Herøya, Norway.

Germany's hydrogen plan allocates €8 million in funding for Siemens Energy's synthetic fuel initiative. Moreover, the EU's dedication to zero-emission vehicles after 2035 and the amended Renewable Energy Directive are crucial regulatory instruments influencing this expansion. Policy and innovation are collectively establishing Europe as the foundation of global e-fuel advancement.

Sustainability Analysis

E-fuels signify a pivotal advancement in the pursuit of enduring environmental sustainability. E-fuels utilize renewable power to transform water and carbon dioxide into hydrocarbon fuels, thereby closing the carbon loop by reusing CO₂ instead of generating new emissions. This technique markedly decreases lifecycle emissions, particularly when integrated with renewable energy sources like as wind and solar. E-fuels, in contrast to traditional fuels, are compatible with current engines and infrastructure, facilitating fast implementation without extensive modifications.

The IEA reports that light vehicles constituted more than 25% of global oil consumption and 10% of energy-related CO₂ emissions in 2022, underscoring the opportunity for emission reductions via e-fuels. Legislative frameworks, including the EU's RED and Fit-for-55 packages, enhance sustainability outcomes by requiring renewable content and carbon neutrality. Furthermore, partnerships such as those between INERATEC GmbH and Chiyoda Corporation facilitate the globalization of sustainability objectives.

E-Fuel Market Players

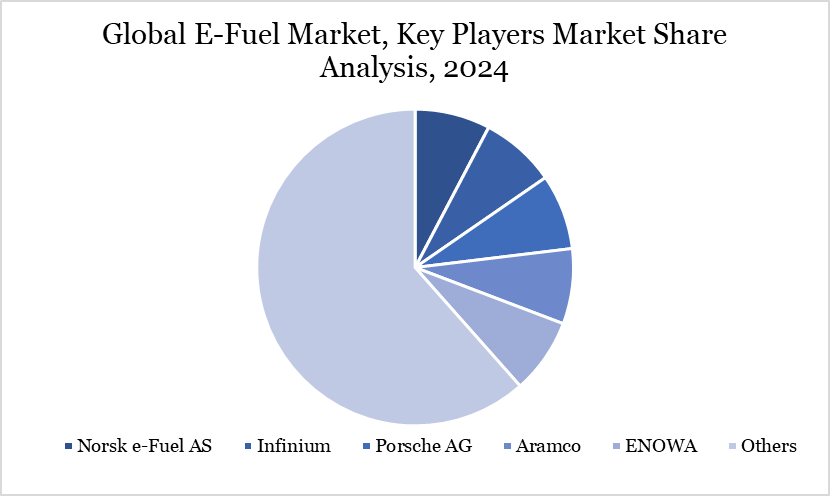

The major global players in the market include Norsk e-Fuel AS, Infinium, Porsche AG, Aramco, ENOWA, Audi AG, Ineratec GmbH, HIF Global, Repsol and Orsted.

Key Developments

- In September 2023, Saudi Arabian Oil Co. and Stellantis partnered to assess the compatibility of e-fuels with European engine facilities. The companies have collaborated utilizing surrogate eFuels for testing, adhering to established fuel standards, in their quest for lower-carbon energy options. Through this agreement, Aramco will employ its e-fuel manufacturing in automobiles.

- In March 2023, Uniper collaborated with the Swedish company Liquid Wind, which is advancing electro-fuel derived from hydrogen to facilitate carbon-neutral transportation. Uniper will become the company's second-largest investor and is currently developing its inaugural eMethanol production facility at Örnsköldsvik, located on Sweden's northeastern coast.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies