Clinical Chemistry Market Size

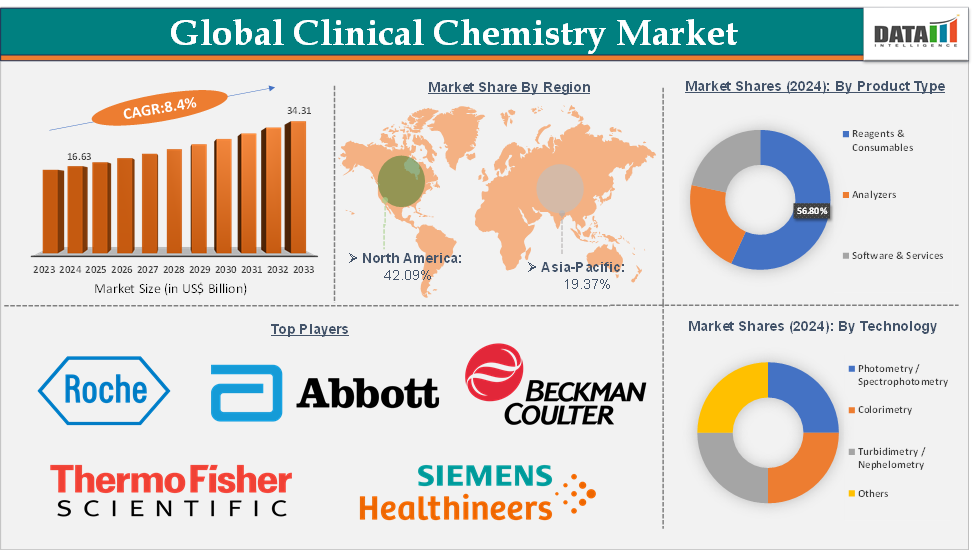

The global clinical chemistry market size reached US$ 16.63 Billion in 2024 from US$ 15.43 Billion in 2023 and is expected to reach US$ 34.31 Billion by 2033, growing at a CAGR of 8.4% during the forecast period 2025-2033.

Clinical Chemistry Market Overview

The clinical chemistry market is evolving as a critical backbone of diagnostic medicine, driven by the rising global burden of chronic diseases such as diabetes, cardiovascular disorders, and liver and kidney conditions. Hospitals and reference laboratories continue to adopt high-throughput, automated analyzers that integrate chemistry with immunoassay systems, streamlining workflows and reducing turnaround times.

For instance, Roche’s cobas platforms and Abbott’s Alinity systems are widely used in core labs for routine metabolic and electrolyte panels. Moreover, the increasing role of connectivity solutions, such as autoverification and remote monitoring, highlights the digital transformation underway in laboratory medicine. Together, these trends position clinical chemistry as a resilient and innovation-driven segment of the broader in-vitro diagnostics landscape, balancing established routine testing with advancements that support precision, efficiency, and global accessibility.

Executive Summary

Clinical Chemistry Market Dynamics

Drivers:

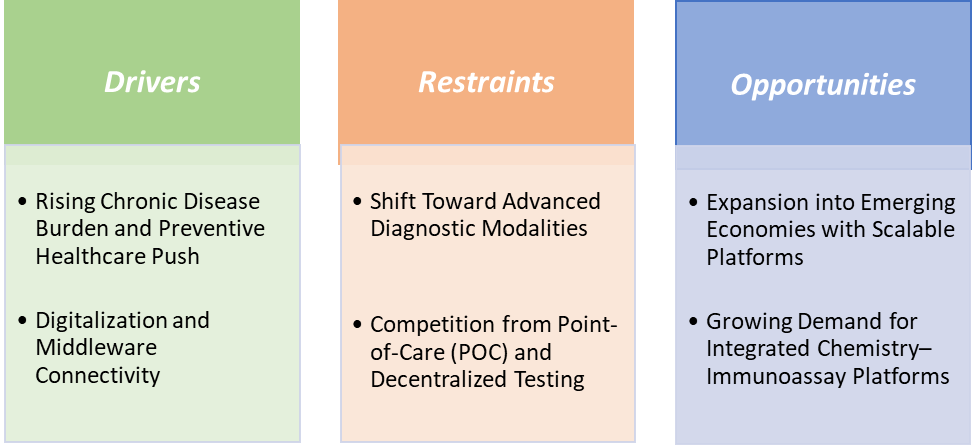

Rising chronic disease burden and preventive healthcare push are significantly driving the clinical chemistry market growth

The rising burden of chronic diseases, coupled with the global push for preventive healthcare, is one of the most significant drivers for the growth of the clinical chemistry market. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 Americans have at least one chronic disease, and 4 in 10 have two or more chronic diseases. These diseases require continuous monitoring through routine laboratory tests such as blood glucose, HbA1c, lipid profiles, liver function tests, and renal function panels, which are all core offerings of clinical chemistry analyzers.

In emerging economies like India and China, governments are rolling out population-wide diabetes and hypertension screening programs, heavily reliant on chemistry-based tests. Preventive healthcare policies worldwide now emphasize early detection and risk stratification, encouraging even asymptomatic individuals to undergo routine chemistry panels during wellness checkups.

Hospitals and diagnostic chains are responding by expanding access to high-throughput automated chemistry analyzers for large-scale chronic disease surveillance. Furthermore, insurance providers and corporate wellness programs incentivize regular checkups, further increasing testing volumes. This convergence of rising chronic disease prevalence and preventive health initiatives ensures steady, recurring demand for clinical chemistry tests, positioning them as indispensable tools in both hospital care and public health strategies.

Restraints:

Shift toward advanced diagnostic modalities is hampering the growth of the clinical chemistry market

The shift toward advanced diagnostic modalities is increasingly hampering the growth trajectory of the clinical chemistry market, particularly in developed healthcare systems. While clinical chemistry remains essential for baseline metabolic, liver, renal, and electrolyte testing, many disease areas are moving toward more specific and sensitive technologies.

For instance, in cardiology, physicians are now relying more on high-sensitivity troponin assays through immunoassay platforms rather than CK-MB and LDH, which are traditionally measured on chemistry analyzers. Similarly, in oncology, molecular diagnostics and next-generation sequencing (NGS) are being prioritized for personalized cancer care, reducing reliance on nonspecific chemistry markers like alkaline phosphatase or LDH.

Infectious disease testing, once reliant on liver and metabolic panels for indirect diagnosis, has shifted toward PCR-based molecular assays that directly detect pathogens, as seen during the COVID-19 pandemic. Even diabetes monitoring is witnessing technological disruption, with continuous glucose monitoring (CGM) devices decreasing dependence on routine blood glucose tests in certain patient groups. As advanced modalities capture attention and funding, clinical chemistry’s role, though still indispensable, becomes relatively less prioritized in long-term diagnostic strategies.

For more details on this report – Request for Sample

Clinical Chemistry Market, Segment Analysis

The global clinical chemistry market is segmented based on product type, test type, technology, end-user, and region.

The reagents & consumables segment from the product type is dominating the clinical chemistry market with a 56.8% share in 2024

The reagents and consumables segment dominates the clinical chemistry market primarily because they are indispensable for every diagnostic test performed, creating a steady and recurring revenue stream. Rising chronic disease incidence, particularly diabetes and cardiovascular conditions, has significantly increased reagent consumption, as patients require frequent monitoring through chemistry-based assays. Preventive healthcare programs, such as the CDC’s preventive screening initiatives in the US and national health check-up schemes in India and China, further accelerate reagent demand by expanding routine population-level testing.

Ongoing innovation in reagent formulations, including high-sensitivity assays, multi-parameter reagent kits, and reagents compatible with automated and integrated analyzers, has enhanced diagnostic accuracy and broadened their applications. Large hospitals, diagnostic centers, and independent labs often enter into long-term reagent supply agreements with analyzer manufacturers, guaranteeing continuous utilization and revenue stability for suppliers. This high-frequency usage, combined with their critical role in test reliability and accuracy, makes reagents and consumables the true revenue backbone of the clinical chemistry market, firmly positioning them as the dominant segment globally.

Geographical Analysis

North America is expected to dominate the global clinical chemistry market with a 42.09% in 2024

North America remains the dominant region in the global clinical chemistry market, largely due to its advanced healthcare infrastructure, high adoption of automation, and strong presence of leading market players. The US healthcare system performs millions of routine diagnostic tests daily, with clinical chemistry analyzers forming the backbone of testing for diabetes, cardiovascular disease, kidney disorders, and liver conditions, which are highly prevalent in the region.

For instance, the CDC’s National Diabetes Prevention Program and widespread cholesterol and metabolic screening initiatives continually drive testing volumes. The region also leads in adopting high-throughput automated analyzers and integrated platforms, companies like Roche, Abbott, and Siemens Healthineers maintain strong market penetration through flagship systems such as the cobas, Alinity, and Atellica lines.

North America has been quick to adopt digital integration, middleware solutions, and AI-driven laboratory automation, making clinical chemistry more efficient and reliable. In Canada, national healthcare programs emphasize preventive testing, further reinforcing demand for routine chemistry panels. With an aging population, high chronic disease burden, and well-established reimbursement structures, North America continues to dominate not only in revenue share but also in setting technological and operational benchmarks for the global clinical chemistry market.

Competitive Landscape

Top companies in the clinical chemistry market include Abbott, F. Hoffmann-La Roche Ltd, Beckman Coulter, Inc., Thermo Fisher Scientific Inc., Siemens Healthcare Private Limited, Sysmex Corporation, Mindray Medical India Pvt. Ltd., QuidelOrtho Corporation, Bio-Rad Laboratories, Inc. and Hitachi, Ltd., among others.

Clinical Chemistry Market, Key Developments

In July 2025, Diatron, a STRATEC brand, well-positioned in developing, manufacturing and marketing hematology and clinical chemistry analyzers and associated reagents for human medical and veterinary use, launched its new clinical chemistry analyzer, the P780. The system is designed to provide outstanding performance and maximum efficiency and safety, without compromising affordability, to meet the growing demands of modern laboratories.

For instance, in July 2025, Diatron launched its new clinical chemistry analyzer, the P780. The system is designed to provide outstanding performance and maximum efficiency and safety, without compromising affordability, to meet the growing demands of modern laboratories.

In March 2025, Beckman Coulter Diagnostics announced that the new DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay analyzer, received 510(k) clearance from the U.S. Food and Drug Administration. The DxC 500i combines advanced technology with an intuitive user interface, ensuring that laboratories of all sizes can meet the growing demands of modern healthcare. With throughput of up to 800 clinical chemistry tests per hour and 100 immunoassay tests per hour, this analyzer delivers precise and reliable results critical for timely clinical decision-making.

In February 2025, HUMAN Diagnostics launched its advanced clinical chemistry instruments, scheduled to debut at Medlab Middle East in Dubai. This milestone reflects HUMAN’s commitment to delivering innovative and reliable diagnostic solutions that meet the needs of modern laboratories worldwide.

Report Scope

Metrics | Details | |

CAGR | 8.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Analyzers, Reagents & Consumables and Software & Services |

Test Type | Routine Panels, Organ-Specific Tests, Disease-Specific Monitoring, and Specialty Assays | |

Technology | Photometry / Spectrophotometry, Colorimetry, Turbidimetry / Nephelometry and Others | |

End-User | Hospitals, Clinical Laboratories, Specialty Clinics, Diagnostic Centers, Academic and Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global clinical chemistry market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here