Cerebral Spinal Fluid (CSF) Shunt Systems Market Size

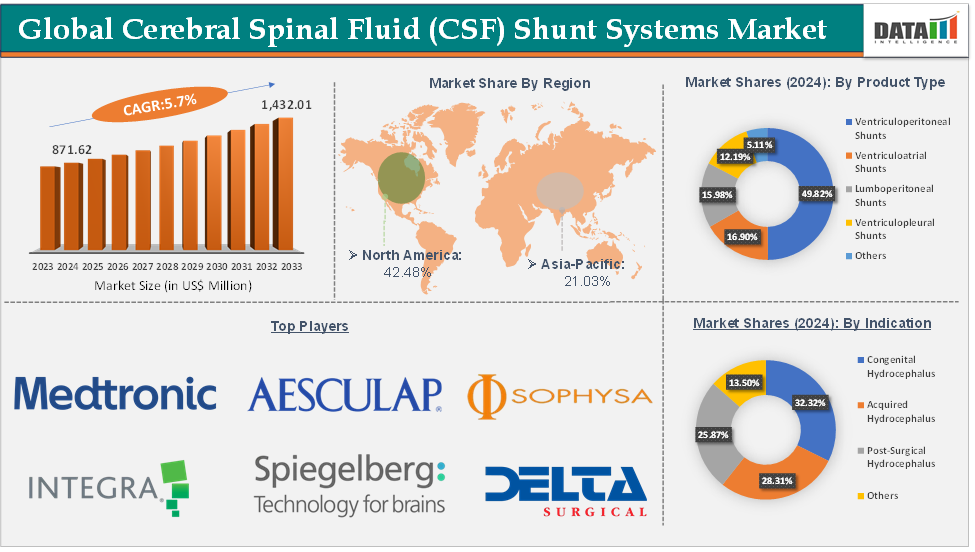

The global cerebral spinal fluid (CSF) shunt systems market size reached US$ 871.62 Million in 2024 and is expected to reach US$ 1,432.01 Million by 2033, growing at a CAGR of 5.7% during the forecast period 2025-2033.

Cerebral Spinal Fluid (CSF) Shunt Systems Market Overview

The cerebral spinal fluid (CSF) shunt systems market is poised for substantial growth, driven by technological advancements, increasing prevalence of hydrocephalus, and expanding healthcare access in emerging regions. Stakeholders across the healthcare and medical device sectors have significant opportunities to capitalize on these trends. With ongoing R&D focused on safer, smarter, and more patient-friendly shunts, the CSF shunt systems market is poised for robust growth through 2033, particularly in programmable devices and emerging geographies. Strategic collaborations between device manufacturers, neurosurgical centers, and digital health firms will be key to unlocking next-generation solutions and expanding global reach.

Cerebral Spinal Fluid (CSF) Shunt Systems Market Executive Summary

Cerebral Spinal Fluid (CSF) Shunt Systems Market Dynamics

Drivers:

The rising prevalence of hydrocephalus is significantly driving the cerebral spinal fluid shunt systems market growth

According to the Hydrocephalus Association, over 1,000,000 people in the United States currently live with hydrocephalus. Normal pressure hydrocephalus (NPH) is most commonly seen in adults aged 60 or over. A recent study estimates that 800,000 older Americans may be living with NPH. It is estimated that more than 80% of cases remain unrecognized or untreated. The primary treatment for managing this condition is the surgical implantation of CSF shunt systems that divert excess fluid to other parts of the body, which directly accelerating the market growth.

Pediatric hydrocephalus, often congenital, represents nearly 45% of the CSF shunt market revenue as children typically require lifelong management and multiple shunt revisions, increasing the volume and complexity of procedures. For instance, according to the Hydrocephalus Association, in the US, 1 out of 770 babies develops hydrocephalus each year, necessitating shunt placement.

Technological advancements in stunt systems is significantly driving the cerebral spinal fluid shunt systems market growth

Technological advancements are a major growth opportunity for the market by improving treatment efficacy, patient safety, and reducing complications. Programmable valves allow non-invasive adjustment of cerebrospinal fluid drainage pressure after implantation, reducing the need for revision surgeries. This innovation has boosted adoption rates, with programmable valves.

Integration of anti-siphon and flow-regulating technologies minimizes risks like over-drainage and under-drainage, common complications in traditional shunts, improving patient outcomes and extending device lifespan. The development of biocompatible and infection-resistant materials has significantly lowered infection rates, a major cause of shunt failure. For instance, shunt infections, historically occurring in up to 30% of cases, are decreasing due to these material innovations.

Restraints:

High risk of post-implantation complications is hampering the growth of the market

Post-implantation complications not only affect patient outcomes but also lead to additional healthcare costs, increased treatment time and a decrease in patient and provider confidence in shunt technologies. Infections are one of the most common complications after CSF shunt implantation. For instance, according to ScienceDirect, shunt infection rates range from about 5% to 15%, with most infections resulting from wound contamination. Almost 70% of infections are caused by skin flora staphylococcal organisms. CSF shunt infections usually occur within 2 months after implantation.

Infections can lead to serious complications such as meningitis or sepsis, requiring the shunt to be replaced and the patient to undergo intensive treatment, including antibiotics or even re-surgery. The need for repeated surgeries increases the overall healthcare costs and impacts the long-term viability of shunt systems, limiting their market acceptance.

Opportunities:

Integration of smart and sensor-enabled shunt technologies creates a market opportunity for cerebral spinal fluid shunt systems market

The integration of smart and sensor-enabled technologies in CSF shunt systems is creating a significant market opportunity by transforming traditional treatment into a more precise, personalized, and proactive care approach. Sensor-enabled shunts can continuously monitor intracranial pressure and shunt function, alerting clinicians and patients to potential blockages or malfunctions before symptoms worsen. This early detection reduces emergency interventions and costly hospitalizations.

Though still emerging, smart shunt technology adoption is accelerating, driven by increasing demand for better management of complex hydrocephalus cases, especially in aging populations. This innovation opens a new segment within the broader CSF shunt market, expected to grow as these devices become more affordable and clinically validated.

For more details on this report – Request for Sample

Cerebral Spinal Fluid (CSF) Shunt Systems Market, Segment Analysis

The global cerebral spinal fluid shunt systems market is segmented based on product type, material, valve type, indication, end-user, and region.

Ventriculoperitoneal shunts from the product type segment are expected to hold 49.82% of the market share in 2024 in the cerebral spinal fluid shunt systems market

Ventriculoperitoneal shunts are considered the gold standard in treating hydrocephalus, especially in congenital cases. This widespread use in both pediatric and adult populations significantly contributes to their market dominance. Ventriculoperitoneal shunts are highly effective in the long-term management of hydrocephalus, with studies showing that they are successful in reducing symptoms and improving patient outcomes, especially when timely intervention is applied.

Due to the wide advantages offered by ventriculoperitoneal shunts, major and emerging market players are focussing on the development of these stunts, which driving the segment growth. For instance, in May 2024, CereVasc, Inc. approval from the US Food and Drug Administration (FDA) to initiate its "Pivotal Study to Evaluate the Safety and Effectiveness of the CereVasc eShunt System in the Treatment of Normal Pressure Hydrocephalus" (STRIDE trial). The STRIDE pivotal study compares the safety and efficacy of its novel eShunt System for the treatment of patients with Normal Pressure Hydrocephalus to treatment with the current standard of care, the ventriculoperitoneal (VP) shunt.

Cerebral Spinal Fluid (CSF) Shunt Systems Market, Geographical Analysis

North America is expected to dominate the global cerebral spinal fluid shunt systems market with a 42.48% share in 2024

According to the Hydrocephalus Association, over 1,000,000 people in the United States currently live with hydrocephalus. Placement of cerebral spinal fluid (CSF) shunt systems to treat hydrocephalus is a common medical procedure and a life-saving treatment for many patients. These shunt systems drain excess fluid from the brain to another part of the body where the fluid is absorbed as part of the circulatory process. As the prevalence is rising in the region, the demand for the market will continuously rise.

North America is home to the most advanced shunt technologies. Companies in the region have pioneered the development of programmable shunts and anti-siphon devices, which offer better control over cerebrospinal fluid flow and minimize the risk of complications such as infection or over-drainage. These innovations enhance patient outcomes and make CSF shunt systems more effective, leading to greater adoption and market share.

For instance, in August 2024, Aesculap, Inc. (Aesculap), in partnership with Christoph Miethke GmbH & Co. KG (MIETHKE), cleared that the U.S. Food and Drug Administration (FDA) granted Breakthrough Device Designation for the M.scio System. This unique, non-invasive, telemetric pressure measurement system is designed to provide continuous access to long-term, intracranial pressure (ICP) monitoring of cerebrospinal fluid (CSF) for the management of hydrocephalus via a permanent, fully implantable sensor.

Asia-Pacific is growing at the fastest pace in the cerebral spinal fluid shunt systems market, holding 21.03% of the market share

Countries like China, India, and Japan are significantly increasing healthcare spending and upgrading neurosurgical facilities, making advanced treatments like CSF shunting more accessible. Countries such as India and Thailand are emerging as medical tourism hubs for affordable neurosurgical care, including hydrocephalus treatment, attracting international patients and boosting market growth. These trends collectively position Asia-Pacific as the fastest-growing regional market, presenting lucrative opportunities for manufacturers and healthcare providers alike.

Cerebral Spinal Fluid (CSF) Shunt Systems Market Competitive Landscape

Top companies in the cerebral spinal fluid shunt systems market include Medtronic, Aesculap, Inc., Sophysa, Integra LifeSciences Corporation, Christoph Miethke GmbH & Co. KG, Delta Surgical, Anuncia Inc., Spiegelberg GmbH & Co. KG, HpBio, and Bıçakcılar, among others.

Cerebral Spinal Fluid (CSF) Shunt Systems Market Scope

Metrics | Details | |

CAGR | 5.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Ventriculoperitoneal Shunts, Ventriculoatrial Shunts, Lumboperitoneal Shunts, Ventriculopleural Shunts, and Others |

Material | Silicone-based Shunts, Polymer-based Shunts, and Metal-based Shunts | |

Valve Type | Fixed Pressure Valves and Adjustable Pressure Valves | |

Indication | Congenital Hydrocephalus, Acquired Hydrocephalus, Post-Surgical Hydrocephalus, and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cerebral spinal fluid shunt systems market report delivers a detailed analysis with 78 key tables, more than 75 visually impactful figures, and 166 pages of expert insights, providing a complete view of the market landscape.