Central Venous Catheters Market Size& Industry Outlook

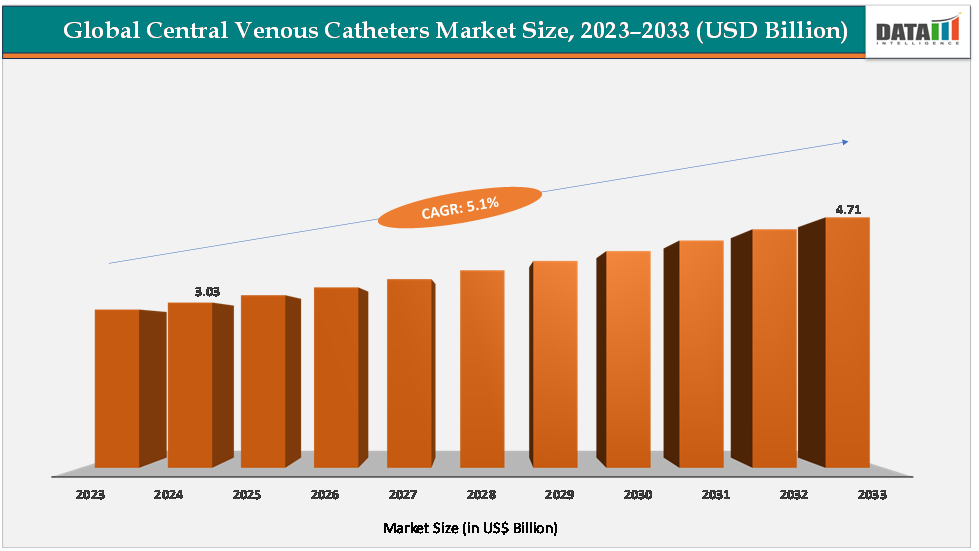

The global central venous catheters market size reached US$3.03Billion in 2024 from US$2.89Billionin 2023 and is expected to reach US$ 4.71Billion by 2033, growing at a CAGR of 5.1%during the forecast period 2025-2033.

The market is expanding due to rising demand across oncology, dialysis, and critical care, with specific product types fueling growth. For instance, implantable ports such as BD’s PowerPort and AngioDynamics’ SmartPort are increasingly used in chemotherapy for long-term, reliable venous access. Similarly, the growing number of chronic kidney disease patients is driving the adoption of dialysis catheters like Merit Medical’s ProGuide for hemodialysis treatment. In ICUs, multi-lumen acute CVCs such as Teleflex’s Arrowg+ard Blue remain essential for rapid fluid delivery and monitoring. These factors are accelerating the growth of the market.

Key Market Highlights

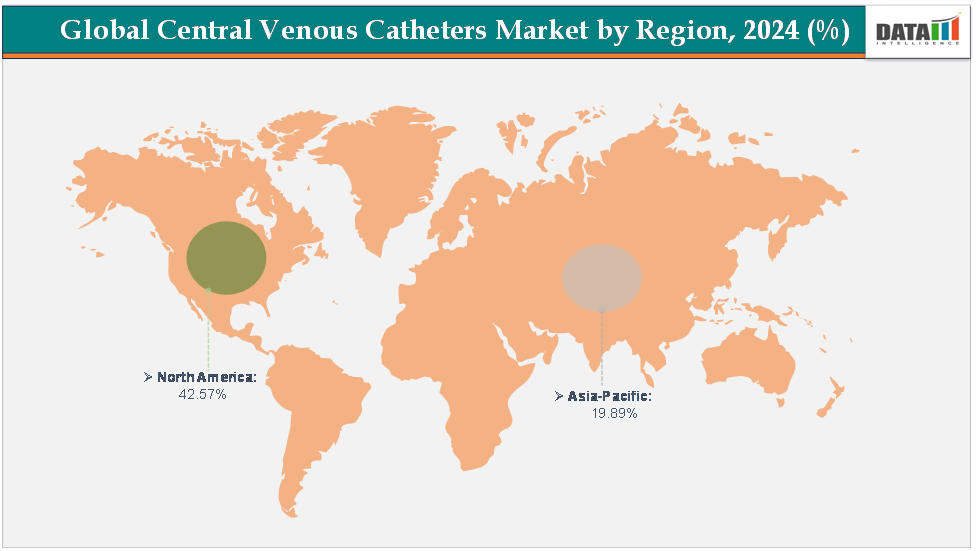

North America dominates the central venous catheters market with the largest revenue share of 42.57% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of5.7% over the forecast period.

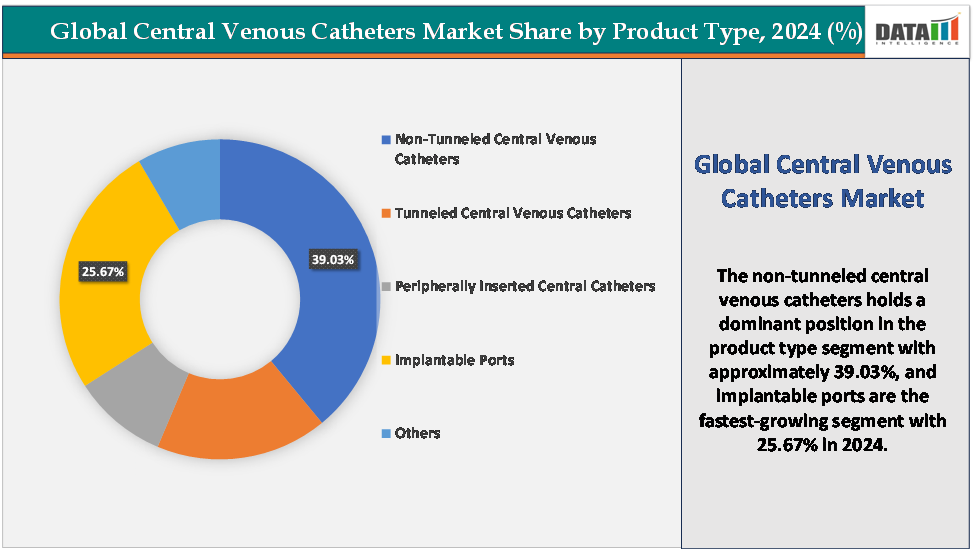

Based on product type, the non-tunneled central venous catheters segment led the market with the largest revenue share of 39.03% in 2024.

The major market players in the central venous catheters market are BD, Teleflex Incorporated, B. Braun SE, Cook Medical, Angio Dynamics, ICU Medical, Inc., Merit Medical Systems, and Vygon Group, among others

Market Dynamics

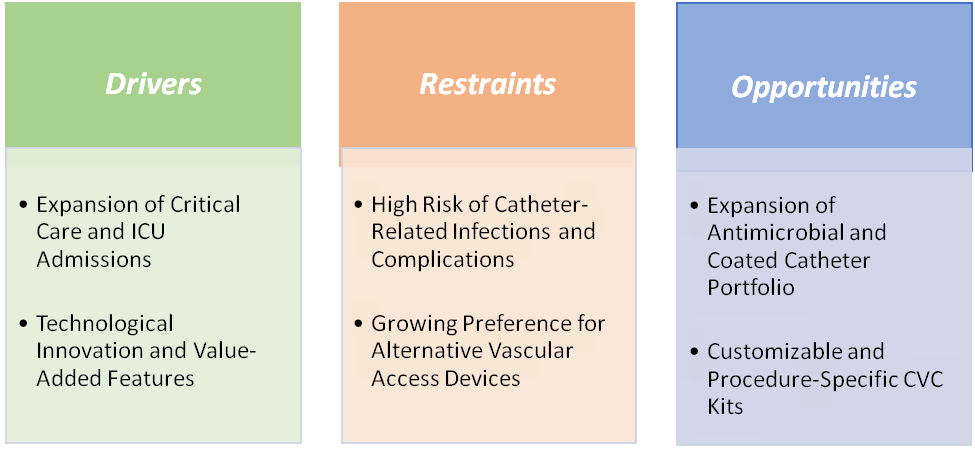

Drivers: Expansion of critical care and ICU admissions is significantly driving the central venous catheters market growth

The expansion of critical care and ICU admissions is a major factor fueling the growth of the central venous catheters market, as these devices are indispensable in managing critically ill patients. According to the Society of Critical Care Medicine (SCCM), more than 5 million patients are admitted annually to U.S. ICUs. In ICUs, non-tunneled central venous catheters are most commonly used because they allow rapid administration of large-volume fluids, vasoactive drugs, and parenteral nutrition, while also enabling central venous pressure monitoring. For instance, Teleflex’s Arrow non-tunneled central venous catheters and B. Braun’s Certofix acute central venous catheters are standard choices in emergency and critical care protocols worldwide.

The increasing burden of conditions like sepsis, trauma, and multi-organ failure is directly translating into higher central venous catheter placement rates. Furthermore, the growing incidence of complex surgeries and critical care interventions in aging populations is boosting the demand for multi-lumen catheters, which enable simultaneous infusion of incompatible drugs. With ICU capacity expanding globally, especially in emerging markets like India and China, where healthcare infrastructure is scaling rapidly, the demand for acute care central venous catheters, insertion kits, and bundled sterile packs is expected to grow substantially.

Restraints: High risk of catheter-related infections and complications is hampering the growth of the market

The high risk of catheter-related infections and complications is a critical factor hampering the growth of the central venous catheters market, despite the devices’ indispensable role in critical and chronic care. Catheter-related bloodstream infections (CRBSIs) are among the most serious concerns, often leading to prolonged hospital stays, higher treatment costs, and increased patient morbidity. For instance, non-tunneled central venous catheters, which dominate ICU use, are typically associated with higher infection rates due to their short-term placement in high-risk environments. Complications such as thrombosis, pneumothorax, or catheter malposition further add to the clinical and economic burden.

Although antimicrobial-coated catheters like Teleflex’s Arrowg+ard Blue and B. Braun’s antimicrobial Certofix lines have demonstrated reductions in infection rates, their higher costs limit widespread adoption, particularly in developing markets. Hospitals facing strict infection-control mandates sometimes restrict central line use to only the most necessary cases, preferring alternatives like midline catheters or peripheral IVs when possible. This combination of clinical risk, financial burden, and regulatory scrutiny acts as a restraint on market expansion, slowing adoption of central venous catheters despite their proven therapeutic value.

For more details on this report – Request for Sample

Segmentation Analysis

The global central venous catheters market is segmented based on product type, end-user, and region.

Product Type:

The non-tunneled central venous catheters segment is dominating the central venous catheters market with a 39.03% share in 2024

The non-tunneled central venous catheters segment dominates the central venous catheters market due to its critical role in acute and emergency care, where immediate vascular access is essential. These catheters are widely used in ICUs, operating rooms, and emergency departments for short-term needs such as rapid fluid resuscitation, administration of vasoactive drugs, parenteral nutrition, and central venous pressure monitoring.

Products like Teleflex’s Arrow non-tunneled CVCs and B. Braun’s Certofix Acute catheters are frontline choices for clinicians, reflecting their reliability and ease of insertion. Their comparatively lower cost and higher procedural volumes also contribute to the segment’s dominance, making them more accessible across both developed and emerging markets. Additionally, multi-lumen designs allow simultaneous administration of incompatible medications, adding versatility in critical care scenarios. With the growing prevalence of sepsis, trauma, and complex surgeries, the demand for non-tunneled central venous catheters remains consistently high, reinforcing their status as the largest revenue-contributing segment in the market.

The implantable ports arethe fastest-growing segment in thecentral venous catheters market,with a 25.67% share in 2024

The implantable ports segment is the fastest-growing in the central venous catheters market, largely driven by the rising burden of cancer and chronic diseases that require long-term vascular access. They are especially valuable in oncology, where patients undergo months of chemotherapy, blood draws, and supportive therapies. Products such as BD’s PowerPort, AngioDynamics’ SmartPort, and ICU Medical’s Port-A-Cath are widely used in cancer centers and are being adopted in outpatient infusion clinics due to their comfort and lower maintenance requirements compared to external lines.

The global expansion of outpatient and home-based infusion therapy is further accelerating its use, as ports reduce the need for frequent venipuncture and improve patient quality of life. Technological advances, such as power-injectable ports that withstand high-pressure contrast injections for imaging, also enhance clinical utility and broaden their applications. With their longer dwell time, implantable ports are capturing strong growth momentum, positioning this segment as the fastest-expanding category within the market.

Geographical Analysis

North America is expected to dominate the global central venous catheters market with a 42.57% in 2024

North America is the dominant region in the global central venous catheters market, supported by its high procedure volumes and rapid adoption of innovative vascular access technologies. With its robust demand across critical care, oncology, and dialysis, the region continues to generate the largest revenue share globally in the central venous catheters market.

US Central Venous Catheters Market Trends

The US has a large base of critically ill patients requiring ICU admissions, cancer patients needing chemotherapy ports, and chronic kidney disease patients using dialysis catheters, all of which drive steady CVC demand. For instance, products like Teleflex’s Arrow non-tunneled catheters, BD’s PowerPort implantable ports, and ICU Medical’s Port-A-Cath systems are extensively used across hospitals and cancer centers in the U.S. The high prevalence of chronic illnesses, over 800,000 patients living with end-stage renal disease in the US, ensures consistent usage of tunneled and dialysis central venous catheters. Strong presence of leading manufacturers like Becton Dickinson, Teleflex, AngioDynamics, and ICU Medical, combined further consolidates theUS leadership.

The Asia Pacific region is the fastest-growing region in the global central venous catheters market, with a CAGR of 5.7% in 2024

The Asia-Pacific region is the fastest-growing in the global central venous catheters market, fueled by rising disease prevalence and increasing adoption of advanced vascular access devices. Rapid urbanization and lifestyle changes have led to a surge in cancer cases and chronic kidney disease, driving demand for long-term devices like implantable ports such as BD PowerPort, Angio Dynamics SmartPort for chemotherapy and tunneled dialysis catheters Merit Medical ProGuide, Cook Spectrum for renal therapies.

Simultaneously, growing ICU capacity across countries such as China, India, and Japan is boosting the use of non-tunneled CVCs like Teleflex’s Arrow lines for acute critical care, including sepsis management and emergency interventions. The shift toward outpatient infusion clinics in countries like Japan and South Korea is also accelerating adoption of peripherally inserted central catheters (PICCs) and power-injectable devices. With a large patient base, improving access to advanced therapies, and rising adoption of premium vascular access products, Asia-Pacific is expected to outpace all other regions in central venous catheters market growth.

Europe Central Venous Catheters Market Trends

The central venous catheters market in Europe is experiencing steady growth, driven primarily by the rising prevalence of chronic diseases, aging population, and increasing demand for advanced healthcare interventions. The region has a well-established network of hospitals, oncology centers, and dialysis clinics that rely heavily on implantable ports for long-term chemotherapy, tunneled central venous catheters for chronic renal care, and non-tunneled central venous catheters for ICU and critical care procedures.

Moreover, Europe’s growing focus on outpatient infusion therapy and home-based care has expanded the use of peripherally inserted central catheters and power-injectable ports, improved patient convenience and reducing hospital stays. The prevalence of cancer and chronic kidney disease, combined with a strong emphasis on clinical outcomes and compliance with EU healthcare standards, is reinforcing the demand for reliable and innovative CVC solutions across the region. Additionally, partnerships with leading manufacturers like BD, Teleflex, and ICU Medical are supporting higher utilization of premium products, making Europe a key market for both volume and innovation-driven growth.

Competitive Landscape

Top companies in the central venous catheters market include BD, Teleflex Incorporated, B. Braun SE, Cook Medical, Angio Dynamics, ICU Medical, Inc., Merit Medical Systems, and Vygon Group, among others.

Market Scope

Metrics | Details | |

CAGR | 5.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Non-Tunneled Central Venous Catheters, Tunneled Central Venous Catheters, Peripherally Inserted Central Catheters, Implantable Ports, and Others |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global central venous catheters market report delivers a detailed analysis with 48 key tables, more than 43visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here