Cancer Immunotherapy Market Size

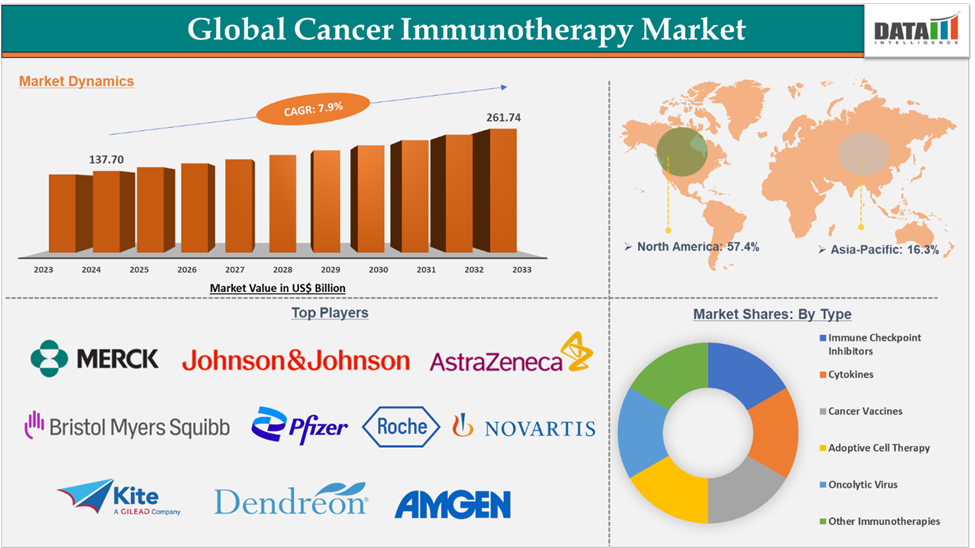

Cancer Immunotherapy Market reached US$ 137.70 billion in 2024 and is expected to reach US$ 261.74 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2025-2033.

The Cancer Immunotherapy Market showed resilience and upward growth in its early stages, moving from US$ 118.63billion in 2022 to US$ 126.93 billion in 2023.

The cancer immunotherapy market is experiencing significant growth due to the rising prevalence of cancer, increasing investments in research and development activities, new immunotherapy drug approvals, and expanding applications of approved immunotherapy drugs to new cancer indications, etc. However, the high cost of immunotherapies, patient adherence, and compliance issues can impact their adoption. The emerging markets provide an opportunity for market expansion in the forecast period.

Cancer immunotherapy, also called immuno-oncology, is a cancer treatment approach that leverages the body's immune system to prevent, manage, and eliminate cancer. It enhances the immune system's ability to identify and target cancer cells more effectively. This method takes advantage of the unique antigens present in tumor cells, allowing the immune system to recognize and attack them once these antigens are properly identified. This market includes several key treatment approaches, such as immune checkpoint inhibitors, monoclonal antibodies, cancer vaccines, CAR-T cell therapies, and cytokines.

Executive Summary

For more details on this report – Request for Sample

Cancer Immunotherapy Market Dynamics: Drivers & Restraints

The rising incidence and prevalence of cancer are driving the market growth

Cancer is one of the major global health concerns, with a substantially high number of cases worldwide. The incidence and prevalence of cancer are rising due to various factors, including the aging population, changes in lifestyle, environmental factors, etc.

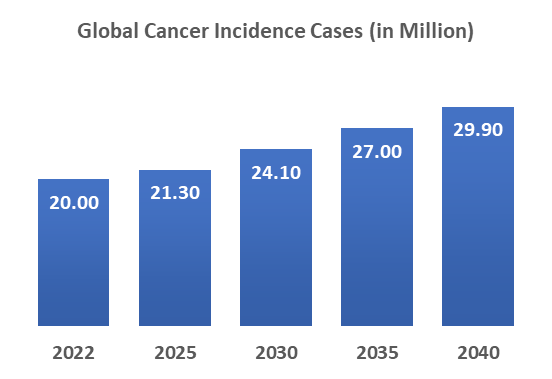

As per the International Agency for Research on Cancer, globally, nearly 20 million incident cases were reported in 2022. In 2030, nearly 24.10 million cases and in 2040, nearly 29.90 million cases were expected.

This alarming rise in cancer cases is driving demand for immunotherapies, which are increasingly seen as an effective alternative to traditional treatments like chemotherapy. As the burden of cancer grows, the need for innovative therapies accelerates, spurring increased investment in research and the development of new immunotherapy options. Thus, the above factor is expected to continue fueling the expansion of the cancer immunotherapy market.

High Cost of Immunotherapies may restrain the market growth

Immunotherapies although a promising treatment option for cancer, their high cost can significantly hinder their adoption, especially in low to middle-income countries and among patients with partial or no insurance coverage. For instance, the most popular cancer immunotherapy drug, pembrolizumab, sold under the brand name Keytruda, is available for $11,795.44 for 3 weeks, and $23,590.88 for 6 weeks for each indicated dose. This high cost not only places a significant burden on patients but also strains healthcare systems and insurance providers.

Some immunotherapy treatment regimens require extended treatment periods or multiple doses over time, further increasing overall costs for patients. The ongoing cost burden can be difficult to manage for both individuals and healthcare providers. As a result, the affordability of these treatments may limit their widespread adoption, slow market penetration, and reduce access for patients who could benefit from these advanced therapies. Thus, the above factors could be limiting the global cancer immunotherapy market's potential growth.

Cancer Immunotherapy Market Segment Analysis

The global cancer immunotherapy market is segmented based on type, indication, and region.

Immune checkpoint inhibitors in the type segment accounted for 37.5% of the market share in 2024 in the global cancer immunotherapy market

Immune checkpoint inhibitors (ICIs) are a class of immunotherapy drugs that function by blocking the checkpoint proteins that play a crucial role in the body’s immune responses. These checkpoint proteins, such as PD-1, PD-L1, and CTLA-4, prevent the overactivation of T-cells that are engaged in killing the cancerous cells. Inhibition of these checkpoint proteins is a key mechanism for targeting several cancers. The examples of immune checkpoint inhibitors are nivolumab, pembrolizumab, and cemiplimab, which inhibit PD-1, while atezolizumab, avelumab, and durvalumab are PD-L1 inhibitors. Ipilimumab is a CTLA-4 inhibitor.

Among several classes of immunotherapy drugs, immune checkpoint inhibitors are widely used due to their ability to activate the body’s immune system to fight the cancerous cells, offering long-term survival benefits to the patients. Moreover, pembrolizumab, sold under the brand name Keytruda, is the top-selling drug at present and has recorded sales of US$ 29.82 billion in 2024. Keytruda is now approved for more than 40 cancer indications in the United States. The applications for these drugs are still expanding due to ongoing research efforts to explore the clinical benefits of the drugs. The key demand areas for Keytruda are triple-negative breast cancer (TNBC), renal cell carcinoma (RCC), and non-small cell lung cancer (NSCLC). Likewise, the other immune checkpoint inhibitors are popular among the top-selling drugs worldwide. Below is the list of top immune checkpoint inhibitors and their sales figures in 2024.

| Brand | Generic Name | Manufacturer | Sales (2024) in US$ Million |

| Keytruda | Pembrolizumab | Merck & Co., Inc. | $ 29,482.00 |

| Opdivo | Nivolumab | Bristol-Myers Squibb Company | $ 9,304.00 |

| Imfinzi | Durvalumab | AstraZeneca | $ 2,530.00 |

| Tecentriq | Atezolizumab | F. Hoffmann-La Roche Ltd | $ 4,137.22 |

| Yervoy | Ipilimumab | Bristol-Myers Squibb Company | $ 4,717.00 |

Cancer Immunotherapy Market Geographical Analysis

North America dominated the cancer immunotherapy market with the highest share of 57.4% in 2024

North America led the Global Cancer Immunotherapy Market in 2022 with a market size of US$ 56.24 billion and expanded further to US$ 60.17 billion in 2023.

North America’s dominance in the global cancer immunotherapy market is attributable to factors such as high incidence and prevalence of cancer, availability of approved immunotherapies, high sales generated by the manufacturers from the region, and strong research and development activities by established and emerging market players.

For instance, according to the International Agency for Research on Cancer, in 2022, the total incidence cases of cancer in North America (the U.S., Canada, and Mexico) were 2.8 million. The projections indicate approximately 3.4 million incidence cases in 2030 and 4 million cases in 2040. This growing burden of cancer is expected to significantly increase the demand for advanced treatment options like immunotherapy.

Moreover, the manufacturers of immunotherapy drugs generate a major portion of their revenue from North America, especially from the United States. For instance, below is the list of top-selling cancer immunotherapy drugs, especially the immune checkpoint inhibitors, and their sales shares from the U.S.

| Brand | Sales (2024) in US$ Million | U.S. Sales | U.S. Share |

| Keytruda | $ 29,482.00 | $ 17,872.00 | 60.62% |

| Opdivo | $ 9,304.00 | $ 5,350.00 | 57.50% |

| Yervoy | $ 2,530.00 | $ 1,599.00 | 63.20% |

| Tecentriq | $ 4,137.22 | $ 2,003.83 | 48.43% |

| Imfinzi | $ 4,717.00 | $ 2,603.00 | 55.18% |

This represents the demand for immunotherapy drugs in the region and reflects North America’s dominance in the global cancer immunotherapy market.

Cancer Immunotherapy Market Major Players

The major players in the Cancer immunotherapy market are Merck & Co., Inc., Johnson & Johnson Services, Inc., Bristol-Myers Squibb Company, AstraZeneca, Pfizer Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Kite Pharma, Inc., Dendreon Pharmaceuticals, and Amgen Inc., among others.

Key Development

- In April 2025, Akeso, Inc. announced that the China’s National Medical Products Administration (NMPA) has approved the supplemental new drug application for ivonescimab. This immunotherapy drug is a first-in-class PD-1/VEGF bispecific antibody approved for use as a monotherapy for the first-line treatment of PD-L1-positive non-small cell lung cancer (NSCLC), who have negative EGFR and ALK gene mutations.

- In September 2024, MSD (known as Merck in the U.S. and Canada) has announced the approval of Keytruda (pembrolizumab) in Japan for certain non-small cell lung carcinoma (NSCLC) and radically unresectable urothelial carcinoma patients.

- In September 2024, F. Hoffmann-La Roche Ltd received the U.S. Food and Drug Administration (FDA) approval for Tecentriq Hybreza (atezolizumab and hyaluronidase-tqjs), anti-PD-(L)1 cancer immunotherapy for multiple cancers. This is the first and only PD-L1 inhibitor in subcutaneous formulation approved in the United States.

Market Scope

| Metrics | Details | |

| CAGR | 7.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Type | Immune Checkpoint Inhibitors, Cytokines, Cancer Vaccines, Adoptive Cell Therapy, Oncolytic Virus and Other Immunotherapies |

| Indication | Non-Small Cell Lung Cancer (NSCLC), Melanoma, Colorectal Cancer, Renal Cell Carcinoma, Breast Cancer, Bladder Cancer, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |