Market Overview

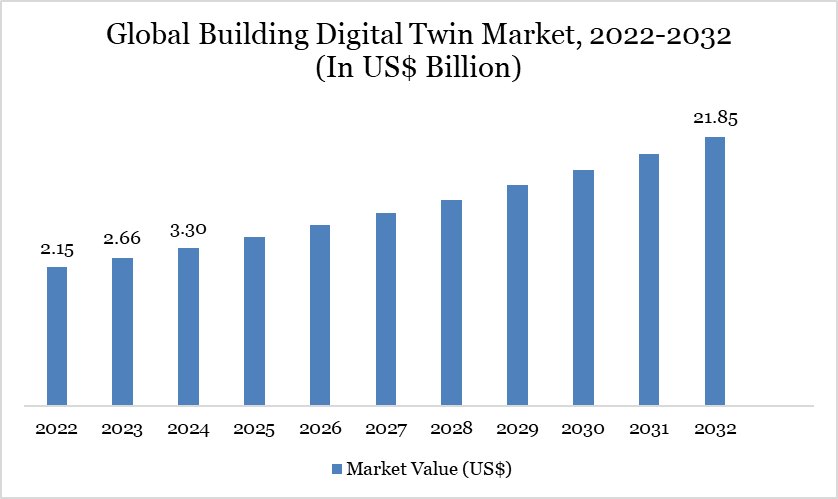

Global building digital twin Market reached US$ 3.30 billion in 2024 and is expected to reach US$ 21.85 billion by 2032, growing with a CAGR of 26.95% during the forecast period 2025-2032.

The global Building digital twin market is rapidly evolving as governments and industries prioritize energy efficiency, operational transparency, and predictive maintenance in the built environment. Historical data shows that the market grew from US$ 1.75 billion in 2021 to US$ 2.66 billion in 2023, reflecting a strong shift toward digital transformation in infrastructure. This growth aligns with increased adoption of digital twins in national sustainability programs.

For example, the European Commission’s Built4People initiative and Horizon Europe funding programs are actively supporting the integration of digital twins into building renovation and smart infrastructure projects. Similarly, the US Department of Energy is investing in digital modeling tools under its Smart Connected Communities and Better Buildings initiatives, driving demand for twin-based platforms in federal and commercial buildings.

Building Digital Twin Market Trend

Governments in the EU are mandating Building Information Modeling (BIM) and digital twin integration for public procurement, which is influencing broader private sector adoption. In Asia, Singapore’s Virtual Singapore project and China’s digital urbanization programs are embedding twin technology into urban planning frameworks. These government-backed initiatives are not only enhancing operational efficiency but also improving resilience and sustainability in urban infrastructure. As nations expand smart city and net-zero carbon targets, digital twin platforms are becoming essential for energy simulation, compliance tracking, and lifecycle performance monitoring. This policy alignment is expected to keep driving long-term adoption across regions.

Market Scope

Metrics | Details |

By Offering | Hardware, Software, Services |

By Deployment | Cloud, On-Premises |

By Application | Energy Management & Optimization, Predictive Maintenance & Asset Monitoring, Occupancy and Space Utilization Analysis, Security & Surveillance Integration, Fire Safety & Emergency Simulation, Smart Building Automation Control, Construction Project Management, Others |

By Digital Twin Type | Component Twin, Asset Twin, System/Process Twin, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Integration of IoT and BIM for Real-Time Energy Optimization

The integration of IoT with Building Information Modeling (BIM) is significantly advancing the global building digital twin market by enabling real-time energy optimization. Smart sensors collect data on occupancy, temperature, and energy flows, feeding into digital twin models for dynamic building performance management. The US Department of Energy reports that buildings using such systems can reduce energy consumption by 20–30%.

The EU’s Smart Readiness Indicator (SRI) and Singapore’s GMIS-EB scheme promote adoption through regulatory and incentive frameworks. In the UK, digital twin models are now core to the National Digital Twin programme, enabling proactive energy management. These applications support global climate targets, as buildings contribute nearly 40% of global CO₂ emissions. The trend is driving demand for smart, interoperable digital twin solutions in both new construction and retrofit projects.

High Initial Implementation and Integration Costs

The global building digital twin market faces a critical restraint in the form of high upfront implementation and integration costs. According to the US General Services Administration (GSA), initial costs for deploying a full-scale digital twin system—including IoT sensors, BIM integration, cloud platforms, and AI analytics—can range between US$ 500,000 to 2 million per commercial facility, depending on scale and complexity.

Similarly, the UK’s Centre for Digital Built Britain highlights that integration with legacy infrastructure and data interoperability challenges often result in extended timelines and inflated project costs. These expenses deter small to mid-sized facility owners and public sector buildings from immediate adoption, especially in regions where digital infrastructure is still evolving. Additionally, training personnel and establishing data governance frameworks adds to the cost burden, creating a barrier for scalable implementation despite the long-term energy and maintenance savings potential.

Segment Analysis

The global building digital twin market is segmented based on offering, deployment, application, digital twin type and region.

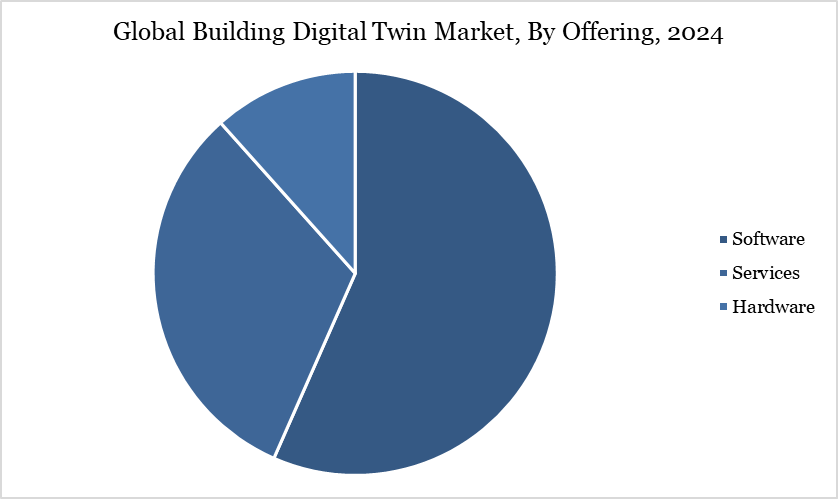

Software Segment Driving Building Digital Twin Market

The software segment is emerging as a primary growth driver in the global building digital twin market, accounting for approximately 48% of the total market share in 2024—valued at around US$ 1.58 billion out of the US$ 3.30 billion total. Governments and companies are investing in scalable platforms that combine Building Information Modeling (BIM), cloud computing, and AI-driven analytics to create accurate and functional digital replicas of physical assets.

For example, the UK’s Centre for Digital Built Britain and the EU’s Horizon Europe programme have both emphasized open-source digital twin software development to support smart building design and energy optimization. Siemens, through its Building X platform, and IBM’s Maximo Application Suite have also expanded integration capabilities with IoT devices, enabling real-time monitoring of HVAC, lighting, and occupancy for commercial facilities. These innovations not only improve building

Geographical Penetration

North America Drives the Global Building Digital Twin Market

North America leads the global building digital twin market, contributing approximately 28% of the total market share in 2024, which equates to around US$ 0.92 billion out of the US$ 3.30 billion global value. This dominance is driven by extensive adoption of digital twin platforms in commercial real estate, smart city development, and federal infrastructure modernization initiatives. The US General Services Administration (GSA) has piloted digital twin technologies across multiple government buildings to improve asset performance, predictive maintenance, and energy management.

Canada’s National Research Council also supports digital modeling for building retrofits and decarbonization under its Green Construction through Wood (GCWood) and Net-Zero initiatives. The region benefits from robust digital infrastructure, strong policy support for energy efficiency, and leading technology providers such as Microsoft, Autodesk, and IBM offering tailored digital twin solutions for buildings and cities. This positions North America as a key force shaping global advancements in building digitalization.

Sustainability Analysis

The global Building Digital Twin market is driving sustainability across the built environment by enabling precise energy, water, and emissions optimization. For instance, Singapore’s “Virtual Singapore” digital twin covers over 50 terabytes of urban data, and has delivered 31% energy savings and a 9.6 kt reduction in carbon emissions at Nanyang Technological University’s campus.

In the UK, digital twins implemented for retrofit projects have achieved 12% energy reductions in net-zero commercial buildings through optimized HVAC controls. Similarly, real-time integration of IoT, sensor, and BIM data in Europe has helped building operators identify and eliminate simultaneous heating + cooling inefficiencies—reducing energy usage by 15–20%. In UAE government buildings, Siemens is rolling out digital twin-driven upgrades across 60 sites to slash energy and water use by 27%, equating to an annual 15,400 t CO₂ emissions reduction.

Competitive Landscape

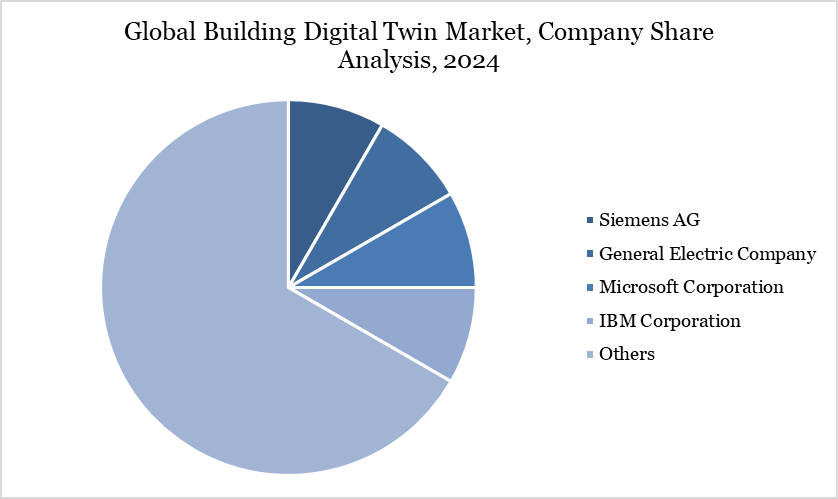

The major global players in the market include Siemens AG, General Electric Company, Microsoft Corporation, IBM Corporation, Dassault Systèmes SE, Autodesk, Inc., Bentley Systems, Incorporated, Oracle Corporation, ANSYS, Inc., and Hexagon AB.

Key Developments

In February 2025, The Department of Telecommunications (DoT) has signed a Letter of Intent (LoI) with the International Telecommunication Union (ITU) to foster collaboration on cutting-edge technologies like AI-driven solutions, digital twins, virtual worlds, and IMT-2030 technologies. The partnership will also focus on developing global standards for interoperability, advancing sustainable development, and promoting citizen-centric urban planning frameworks.

In March 2024, HERE Technologies, the leading location data and technology platform, announced that it has signed a memorandum of understanding (MoU) with data and analytics firm Bedrock Analytics, to spearhead the development of digital twin technologies for Yala's ambitious Smart City initiative.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies