Biosurfactants Market Size

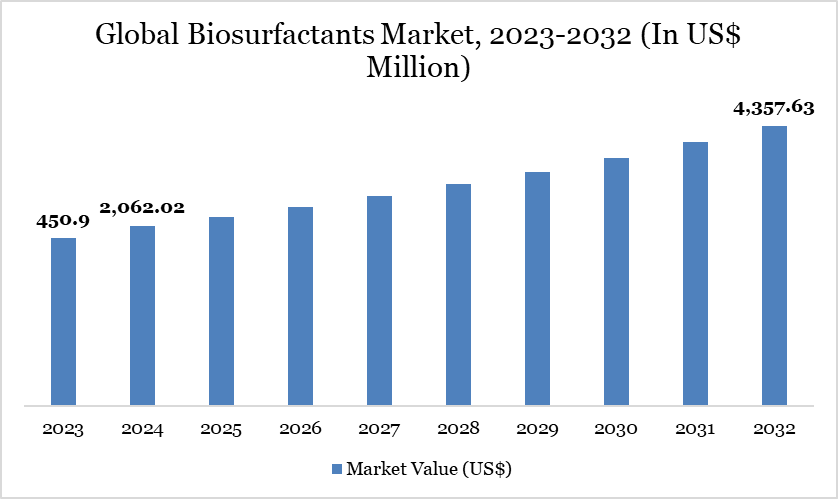

The global market for biosurfactants reached US$2,062.02 million in 2024 and is expected to reach US$4,357.63 million by 2032, growing at a CAGR of 10.1% during the forecast period 2025-2032, according to DataM Intelligence report.

The global biosurfactants market is witnessing steady growth driven by increasing demand for sustainable and eco-friendly surfactants across industries such as detergents, personal care, and oilfield chemicals. Historical data shows the market was valued at US$1,920.53 million in 2023 and rose to US$2,062.02 million in 2024, indicating consistent expansion. The market is projected to maintain this upward trajectory with values expected to reach around US$4,357.63 million by 2032. This growth reflects rising consumer awareness, stricter environmental regulations, and technological advancements in bio-based product manufacturing.

Companies are focusing on R&D and strategic partnerships to capitalize on this trend. For instance, in May 2024, Belgium-based start-up AmphiStar secured €6 million (US$6.43 million) in funding to commercialize its innovative waste-based biosurfactant range. Backed by the European Circular Bioeconomy Fund (ECBF), Qbic III, and the Flanders Future Tech Fund (FFTF), the investment will support the construction of a 1,000-tonne/year launch plant, advance R&D, and complete regulatory certifications.

Biosurfactants Market Trends

The global shift toward sustainable and green chemicals is giving a strong push to the biosurfactants market as industries look for safer, biodegradable alternatives to synthetic surfactants. Growing environmental awareness and regulatory actions are compelling companies to adopt eco-friendly solutions. For instance, in May 2024, the Government of India strengthened its regulatory framework for biostimulants through the Fertiliser (Control) (Third) Amendment Order, 2024, mandating stricter toxicity and bio-efficacy testing. This aligns with the broader trend of ensuring that agricultural inputs, including biosurfactants, meet higher safety standards.

Biosurfactants Market Scope

Metrics | Details |

By Type | Glycolipids, Lipopeptides, Phospholipids, Others |

By Source | Bacteria, Fungi, Agricultural Waste, Others |

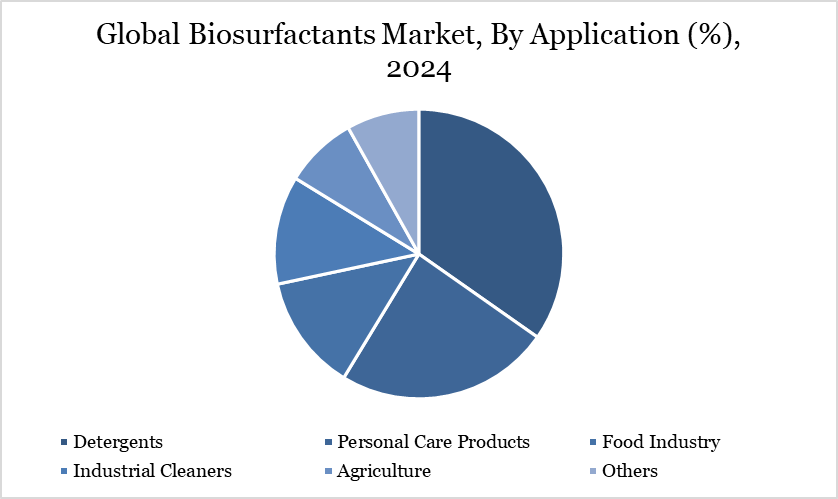

By Application | Detergents, Personal Care Products, Food Industry, Industrial Cleaners, Agriculture, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Increasing Concerns about the Environment

The increasing concerns about environmental sustainability are significantly driving the growth of the global biosurfactants market, as industries across the globe are under pressure to reduce their ecological footprint and transition to greener alternatives. For instance, according to BIOPRO Baden-Württemberg GmbH (2023, stated that major oil spills, such as the Exxon Valdez tanker disaster and the Deepwater Horizon drilling rig explosion in the Gulf of Mexico, continue to have long-lasting environmental impacts. In recent years, additional incidents, including oilfield explosions in Western Siberia and tanker accidents off the Dutch and Peruvian coasts, have caused significant damage, even leading to emergency declarations.

Every year, approximately 1,500 million liters of oil are spilled into the world's oceans, highlighting the urgent need for effective, efficient and environmentally friendly pollution containment solutions. In this context, biosurfactants have emerged as a promising alternative to conventional chemical dispersants due to their biodegradability, lower toxicity and effectiveness in breaking down oil pollutants. Biosurfactants, produced by microorganisms, can emulsify hydrocarbons and enhance their bioavailability for microbial degradation. Their natural origin and ability to function in extreme conditions make them highly suitable for oil spill remediation, helping to mitigate environmental damage while reducing dependency on synthetic chemicals.

High Production Costs

High production costs significantly restrain the growth of the global biosurfactants market, as they make these eco-friendly alternatives less competitive compared to conventional synthetic surfactants, which are mass-produced at a lower cost. Biosurfactants are typically produced through microbial fermentation, which involves the cultivation of microorganisms like bacteria, yeast or fungi.

The raw materials used in the production, such as sugars, oils or glycerol, can be expensive and the fermentation process itself is energy-intensive. Additionally, downstream processing, which involves the recovery, purification and formulation of the biosurfactant, adds further costs to the overall production.

The cost of production for biosurfactants can be up to two to five times higher than that of synthetic surfactants, depending on the type of biosurfactant and production methods used.

For instance, producing rhamnolipids or sophorolipids, which are among the most common biosurfactants, can cost anywhere from US$8 to US$20 per kilogram, while synthetic surfactants like sodium lauryl sulfate (SLS) can cost as little as US$1 to US$2 per kilogram. These higher production costs are a significant challenge for manufacturers, especially in price-sensitive markets such as household detergents and industrial cleaning, where cost-effectiveness is a priority.

Market Segmentation

The global biosurfactants market is segmented based on type, source, application and region.

Detergents Hold a Significant Share in the Global Biosurfactants Market Due To Growing Demand for Eco-Friendly Cleaning Solutions

The need for eco-friendly cleaning solutions has driven the chemical industries to develop sustainable alternatives. Microbial biosurfactants provide numerous advantages that render them especially appropriate for incorporation in detergents. In contrast to plant-based surfactants made from palm oil, microbial biosurfactants obviate the necessity for ecologically detrimental monocultures. They tackle public apprehensions regarding the environmental hazards associated with synthetic or plant-derived biosurfactants. These microbial solutions are entirely biodegradable, exhibit low toxicity and retain their efficacy under high temperature and pH settings, hence improving the performance and durability of detergent compositions.

Recent advancements highlight the growing utilization of microbial biosurfactants in the detergent sector. On October 4, 2024, Trichem South announced their partnership with Holiferm to integrate biosurfactants into their newest laundry detergent compositions. This collaboration illustrates the transition to eco-friendly chemicals in the detergent industry and underscores the increasing significance of biosurfactants in fulfilling consumer preferences for sustainable products.

Geographical Share

Europe Holds a Significant Share due to Strong Sustainability Policies and Industrial Demand

The European market is witnessing remarkable growth, propelled by a surge in demand for eco-friendly surfactants across diverse industries. Forecasted to command a significant share of the global market by 2025, Europe’s leadership in sustainability-driven innovation is setting new benchmarks. This robust growth is underpinned by a confluence of factors, including a shift in consumer preferences toward biodegradable and sustainable products in personal care, home care and industrial applications.

As environmental consciousness grows, Europe is spearheading a transition to sustainable surfactants. Industries such as cosmetics, agriculture, and cleaning are rapidly moving away from petrochemical-based surfactants, favoring biosurfactants derived from renewable raw materials. Regulatory frameworks, including the EU’s Detergents Regulation (EC No 648/2004), are instrumental in this shift, restricting non-biodegradable surfactants and driving demand for eco-friendly solutions in cleaning and personal care. Supporting this trend, consumer sentiment aligns strongly with sustainability; studies reveal that 72% of European consumers prefer products with a reduced environmental footprint, further fueling demand for biosurfactants.

Regulatory Analysis

The global regulatory landscape for biosurfactants is evolving rapidly as sustainability and ingredient transparency gain momentum. In North America, the US FDA, EPA, and USDA govern biosurfactants across food, cosmetics, industrial, and agricultural applications, with the EPA’s Toxic Substances Control Act (TSCA) mandating a Premanufacture Notice (PMN) for new products. Canada enforces its New Substances Notification Regulations under CEPA to assess risks of new living organisms, including biosurfactant-producing microbes. Increasingly, both regions push for higher biodegradability standards and clearer sourcing.

Meanwhile, Europe’s rigorous REACH regulation requires comprehensive safety and environmental data for any new biosurfactant, ensuring chemical safety before market entry. The EU Cosmetics Regulation demands toxicological safety for personal care uses, while the Biocidal Products Regulation (BPR) sets strict efficacy and safety hurdles for disinfectant applications. For food uses, EFSA’s stringent standards and the Novel Food Regulation add further layers of approval, making Europe one of the world’s most demanding markets for biosurfactant compliance.

Competitive Landscape

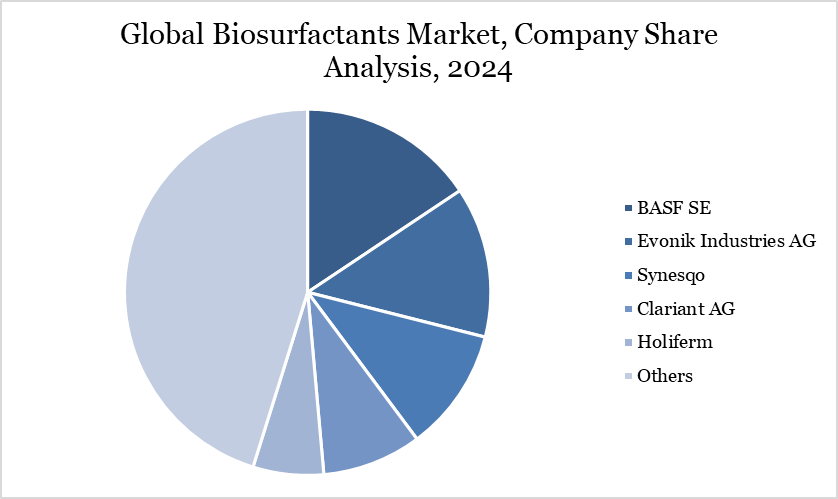

The major global players in the market include BASF SE, Evonik Industries AG, Kaneka Corporation, Wheatoleo, Biosurfactants LLC, Clariant AG, Synesqo, Holiferm, Locus Ingredients, Lankem and others.

Key Developments

In January 2025, Holiferm Limited and Sasol Chemicals, a business unit of Sasol Ltd., announced a collaboration to produce and market rhamnolipids and mannosylerythritol lipids (MELs). This partnership builds on the collaboration initially announced in March 2022, where the two companies joined forces to develop and commercialize sophorolipids, another biosurfactant product.

In September 2024, Evonik will launch two new biosurfactants, TEGO Wet 570 Terra and TEGO Wet 580 Terra, for coatings and inks. These 100% natural, biodegradable products offer excellent performance in wetting pigments and fillers, reducing grinding time and energy use. Suitable for waterborne coatings and inks, they are EU Ecolabel compliant and environmentally friendly, contributing to sustainability in the industry.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies