At-Home Testing Kits Market – Industry Trends & Outlook

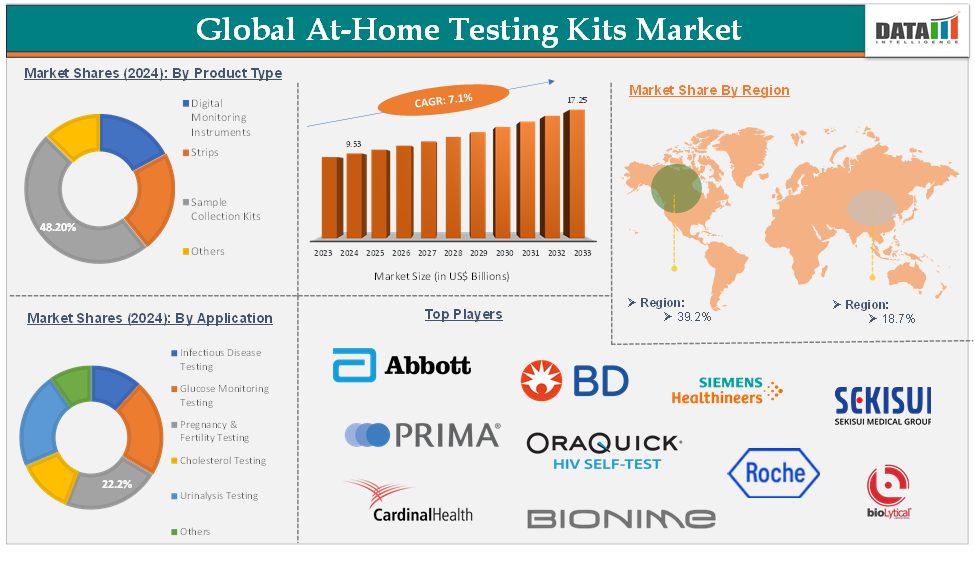

At-Home Testing Kits Market reached US$ 9.53 billion in 2024 and is expected to reach US$ 17.25 billion by 2033, growing at a CAGR of 7.1% during the forecast period of 2025-2033, according to DataM Intelligence report.

At-home testing kits, also known as home use tests, are commercially available medical devices that enable individuals to perform health screenings or monitor various conditions from the comfort of their own homes. These kits, which can be purchased online or at pharmacies, empower users to conveniently test for, detect, or track specific diseases or health parameters without the need for a clinical visit.

Technological advancements are a key driver propelling the growth of the global at-home testing kits market over the forecast period. For instance, in February 2024, Masimo’s MightySat Medical recently received FDA clearance, making it the first and only FDA-cleared fingertip pulse oximeter available without a prescription.

This innovation allows users access to a medical-grade pulse oximeter powered by Masimo SET pulse oximetry technology directly at home. Such advancements are making at-home testing procedures simpler, more efficient, and highly accessible. As a result, consumer adoption of these testing kits is rising, further fueling demand and driving the expansion of the global at-home testing kits market.

Executive Summary

For more details on this report, Request for Sample

At-Home Testing Kits Market Dynamics: Drivers

Advancements in diagnostic technology

Technological advancements are playing a pivotal role in driving the growth of the global at-home testing kits market. As the healthcare sector evolves, there is a rising demand for diagnostic solutions that are rapid, accurate, and easily accessible outside of traditional clinical settings.

Innovations such as biosensors, microfluidics, and lab-on-a-chip systems have significantly enhanced the efficiency, reliability, and user-friendliness of at-home diagnostics. For instance, in September 2024, Abbott Laboratories introduced Lingo, an over-the-counter continuous glucose monitor in the United States. Lingo leverages advanced biosensor technology to provide real-time insights and alert users about sudden changes in blood glucose levels, empowering individuals to manage their health proactively from home.

This type of digital monitoring instrument exemplifies the shift toward smarter, more connected at-home testing solutions. These ongoing advancements are simplifying testing procedures, making them more efficient and accessible for a wider audience. As a result, more people are adopting at-home testing kits, which is accelerating market growth and transforming the way individuals engage with their health.

At-Home Testing Kits Market Dynamics: Restraints

Stringent regulatory requirements

Stringent regulatory requirements are a significant barrier to the growth of the global at-home testing kits market. As these kits are classified as medical devices, they must undergo thorough approval processes by regulatory agencies such as the FDA in the United States and their counterparts worldwide. This process typically involves extensive clinical validation to ensure the accuracy and reliability of test results.

However, regulatory frameworks vary considerably across different regions, leading to a fragmented market landscape. Companies aiming for simultaneous market entry in multiple countries face the added complexity of navigating diverse regulatory standards, documentation protocols, and clinical trial requirements unique to each jurisdiction. These challenges collectively slow down product approvals and market expansion, thereby hampering the growth of the global at-home testing kits market.

At-Home Testing Kits Market - Segment Analysis

The global at-home testing kits market is segmented based on product type, application, sample, distribution channel, and region.

Product Type:

The sample collection kits product type segment is expected to hold 48.2% of the global at-home testing kits market

Sample collection kits represent a vital segment that facilitates accurate, user-friendly, and hygienic sample gathering for diagnostic analysis. These kits are specifically designed to enable individuals to collect biological samples, such as saliva, blood (via finger prick), urine, or stool, in the comfort of their own homes, without the need for professional assistance.

The effectiveness of at-home diagnostic tests largely depends on the quality and integrity of the collected sample, making the design and reliability of these kits critical. Most kits include essential components such as collection tools (e.g., swabs, lancets, collection tubes), clear instructions, and secure packaging for shipping samples to certified laboratories.

With increasing demand for convenient and non-invasive testing options, especially for chronic conditions, infectious diseases, and wellness monitoring, the sample collection kit segment is experiencing robust growth. Innovations in this space, such as pre-labeled vials, integrated barcoding for digital tracking, and IoT-enabled collection devices, are further enhancing usability and accuracy, positioning this segment as a cornerstone of the expanding digital health ecosystem.

For instance, in June 2023, LifeCell introduced a self-sampling test kit designed to help individuals detect the presence of viruses that cause cervical cancer (such as Human Papillomavirus, HPV) and other sexually transmitted diseases (STDs) from the comfort and privacy of their own homes. This innovation is part of the rapidly growing sample collection kits segment in the global at-home testing kits market.

At-Home Testing Kits Market Geographical Analysis

North America is expected to hold 39.2% of the global at-home testing kits market

North America is expected to hold a substantial share of the global at-home testing kits market, driven by its robust healthcare infrastructure, high prevalence of chronic diseases, and rapid technological advancements. The growing incidence of conditions such as diabetes, cardiovascular diseases, and infectious illnesses is a key factor fuelling market growth in the region.

According to the Centers for Disease Control and Prevention, as of 2024, over 38 million Americans, approximately 1 in 10, have diabetes, with 90% to 95% diagnosed with type 2 diabetes. Although type 2 diabetes primarily affects adults over 45, it's increasingly seen in children, teens, and young adults, intensifying the demand for accessible and efficient diagnostic solutions like at-home testing kits.

The presence of major industry players further contributes to regional growth through ongoing innovation and product launches. For instance, in June 2024, Prevounce Health introduced the Pylo GL1-LTE, its first remote blood glucose monitoring device. Designed for reliability, the GL1-LTE supports widespread cellular connectivity across the U.S. and integrates seamlessly with the Prevounce remote care management platform.

It also connects with other health software via the Pylo cloud API. Prevounce's product suite, including cellular-enabled blood pressure monitors and weight scales, reflects a broader trend toward user-friendly, tech-enabled diagnostics. These innovations are streamlining testing processes and accelerating the adoption of at-home testing kits throughout North America. Thus, the above factors are consolidating the region's position as a dominant force in the global at-home testing kits market.

Asia-Pacific is expected to hold 18.7% of the global at-home testing kits market

The Asia Pacific region is emerging as the fastest-growing market for at-home testing kits, owing to rising healthcare funds, increased awareness of early disease diagnosis, the demand for quick and precise diagnostic results, and technological advancements. The need for at-home testing kits has increased as these kits have proven invaluable for the early diagnosis and monitoring of a variety of health disorders, thereby improving disease management results throughout the region.

There are recent launches of devices in this region, making it the fastest-growing region. For instance, in September 2024, Mankind Pharma Ltd. announced the launch of its latest innovation, RAPID NEWS self-test kits, which are intended to address common health conditions such as dengue, urinary tract infections (UTIs), and early menopause.

This launch is a significant step toward accessible healthcare, to provide citizens across India with convenient, confidential, and rapid testing alternatives. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global at-home testing kits market.

At-Home Testing Kits Market Major Players

The major global players in the at-home testing kits market include Abbott, F. Hoffmann-La Roche Ltd, BD, Siemens Healthcare Private Limited, Geratherm Medical AG, OraQuick, SEKISUI Diagnostics, BioLytical Laboratories Inc. (INSTI), PRIMA Lab SA, Nova Biomedical, Everlywell, Cardinal Health, and Bionime Corporation, among others.

Key Developments

In September 2024, Abbott Laboratories announced the launch of Lingo, an over-the-counter continuous glucose monitor, in the United States. One of Abbott's key objectives is to notify Lingo users about glucose spikes, which occur when the quantity of sugar in the bloodstream suddenly rises and subsequently decreases.

In August 2024, DEXIS launched DEXIS Connect Pro, a new proactive service platform for DEXIS CBCT and Intraoral Sensor Devices that focuses on increasing device uptime. This exclusive platform uses Internet of Things (IoT) technology to continuously monitor the health of these devices, ensuring they function optimally.

In February 2024, Masimo announced that MightySat Medical received FDA clearance, making it the first and only FDA-cleared medical fingertip pulse oximeter available without a prescription. This clearance entitles users to a pulse oximeter medical device powered by Masimo SET pulse oximetry.

Market Scope

Metrics | Details | |

CAGR | 7.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Digital Monitoring Instruments, Strips, Sample Collection Kits, Others |

Application | Infectious Disease Testing, Glucose Monitoring Testing, Pregnancy & Fertility Testing, Cholesterol Testing, Urinalysis Testing, Others | |

Sample Type | Urine, Blood, Saliva, Vaginal Swab, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |