Africa and GCC Medical Tourism Market - Industry Trends & Overview

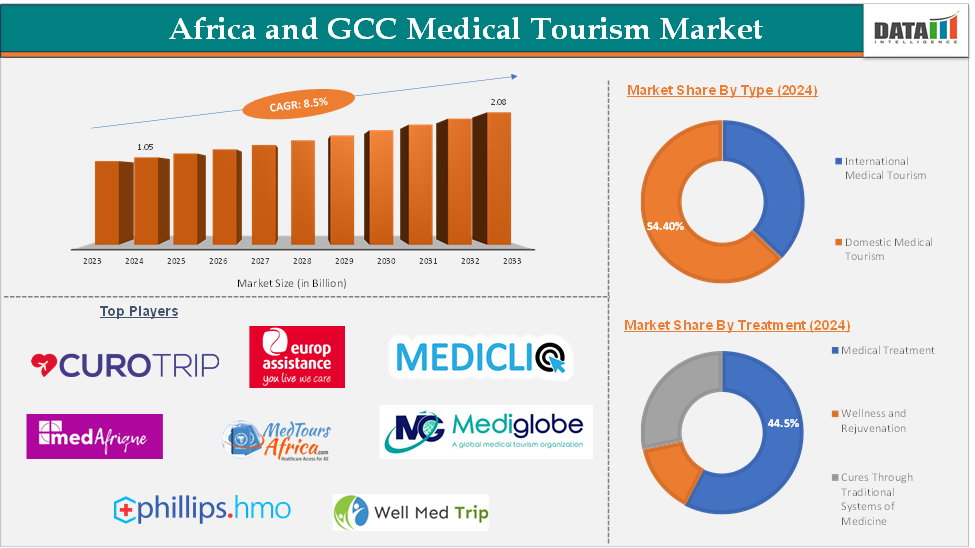

The Africa and GCC Medical Tourism Market size reached US$ 1.05 Billion in 2024 and is expected to reach US$ 2.08 Million by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033.

Medical tourism is defined as traveling to another country for medical care, often motivated by the desire for less expensive procedures, access to treatments unavailable at home, or care from culturally or linguistically aligned healthcare professionals. Many medical tourists also combine their treatment with leisure travel.

Both Africa and the GCC are rapidly developing as significant players in the global medical tourism market, leveraging their unique strengths. Africa, with its affordability and diversity, and the GCC, with its advanced infrastructure and government backing. Both regions are expected to see robust growth in the coming years, driven by increased investment, innovation, and rising global demand for accessible, high-quality healthcare.

Executive Summary

For more details on this report – Request for Sample

Africa and GCC Medical Tourism Market : Drivers

Rising awareness about the low cost of medical procedures

The rising awareness about the low cost of medical procedures is significantly driving the growth of the Africa & GCC medical tourism market. The primary motivation for medical tourism is the substantial cost savings that patients can achieve by seeking medical treatment in other countries with better patient outcomes. This further initiated more efforts for better and more affordable treatments for the patients.

For instance, in April 2025, the collaboration between Healthtrip and Satguru Travel Group is designed to provide African patients with seamless access to world-class healthcare services in countries such as the UAE, India, Turkey, Germany, and Saudi Arabia.

Moreover, in May 2025, the Organisation of Trade Union Organizations of West Africa (OTUWA) is launching a regional campaign against the practice of medical tourism by political elites in West Africa, under the slogan “Our Leaders Must Use Our Hospitals.”

This campaign is a direct response to the widespread trend of politicians and wealthy individuals traveling abroad for medical treatment, while the majority of citizens must rely on underfunded and often inadequate local healthcare systems.

Africa and GCC Medical Tourism Market: Restraints

Medical traveling is a time-consuming process and is associated with some additional costs

Although medical tourism has been growing rapidly, it does come with certain challenges that can hamper its expansion, one of the primary concerns being that medical traveling is a time-consuming process and can incur additional costs.

These factors can deter potential patients from opting for treatment abroad. Traveling abroad for medical treatment involves more than just booking a flight. It typically requires a lengthy planning process that includes obtaining visas, researching medical providers, scheduling consultations, and ensuring appropriate aftercare. This can be a significant barrier for patients with limited time or those needing urgent care.

While the medical procedure itself may be much more affordable abroad, additional travel-related costs can accumulate. These include airfares, accommodation, transport, and often extra costs for post-treatment care or extended stays in the destination country. This can reduce the overall cost-effectiveness of medical tourism for some patients.

Africa and GCC Medical Tourism Market Segment Analysis

The Africa and GCC medical tourism market is segmented based on type, and treatment.

Treatment:

The medical treatment segment is expected to hold 44.5% of the Africa and GCC medical tourism market

The medical treatment segment is the dominant segment in the medical tourism market, contributing significantly to its growth. This segment includes a wide range of medical services such as surgeries, dental procedures, fertility treatments, and cosmetic surgery, all of which are key drivers of medical tourism.

Surgical treatments, both elective and non-elective, make up a substantial part of the medical tourism market. High-demand surgeries like orthopedic surgeries, cardiac surgeries, cosmetic surgeries, and spinal surgeries drive many patients to seek affordable and high-quality care abroad. Cosmetic surgery is one of the fastest-growing sectors within medical tourism.

Procedures such as breast augmentation, liposuction, facelifts, bariatric surgery, and dental implants draw a large number of international patients seeking quality and affordability abroad. For instance, in February 2025, Bahrain has emerged as a global leader in transformative medical tourism by pioneering the use of CRISPR gene-editing therapy for sickle cell disease (SCD), marking a major milestone in precision medicine and healthcare innovation in the Middle East.

The Bahrain Oncology Centre (BOC) successfully treated a patient with SCD using Casgevy (exagamglogene autotemcel), a groundbreaking therapy developed by Vertex Pharmaceuticals and CRISPR Therapeutics.

Medical Tourism Market Global Players

The major players in the global medical tourism market include Raffles Medical Group, Medobal, Bookimed, RealSelf, Inc., KPJ Healthcare Berhad, Japan Dream Tour Co., Ltd., JTB Corp., SilaMed e.K., Medibliss Tours Limited, and American Medical Care, among others.

Africa and GCC Medical Tourism Market - Competitive Landscape (Africa & GCC Players)

The major players in the Africa and GCC medical tourism market include CuroTrip, Europ Assistance, Well Med Trip, Phillips HMO, Medicliq Healthcare, MedTours Africa, Med-Afrique, Global Med care, Netcross Medical Tours, HealthStay.io, Medcol, ShopDoc, and Mediglobe, among others.

Key Developments

- In May 2025, the Organisation of Trade Union Organizations of West Africa (OTUWA) is launching a regional campaign against the practice of medical tourism by political elites in West Africa, under the slogan “Our Leaders Must Use Our Hospitals.”

In April 2025, the collaboration between Healthtrip and Satguru Travel Group is designed to provide African patients with seamless access to world-class healthcare services in countries such as the UAE, India, Turkey, Germany, and Saudi Arabia.

In October 2024, HealthStay.io, a member of the Mohammed Bin Rashid Innovation Fund (MBRIF) Cohort 7 Accelerator, launched the world’s first artificial intelligence (AI)-powered sales and booking management solution specifically designed for medical tourism in the UAE and beyond. This platform represents a major leap forward in how international patients access, book, and manage their medical travel experiences.

Market Scope

Metrics | Details | |

CAGR | 8.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | International Medical Tourism, Domestic Medical Tourism |

Treatment | Medical Treatment, Wellness and Rejuvenation, Cures Through Traditional Systems of Medicine | |

The Africa and GCC medical tourism market report delivers a detailed analysis with 66 key tables, more than 30 visually impactful figures, and 126 pages of expert insights, providing a complete view of the market landscape.