Aerospace Coatings Market Overview

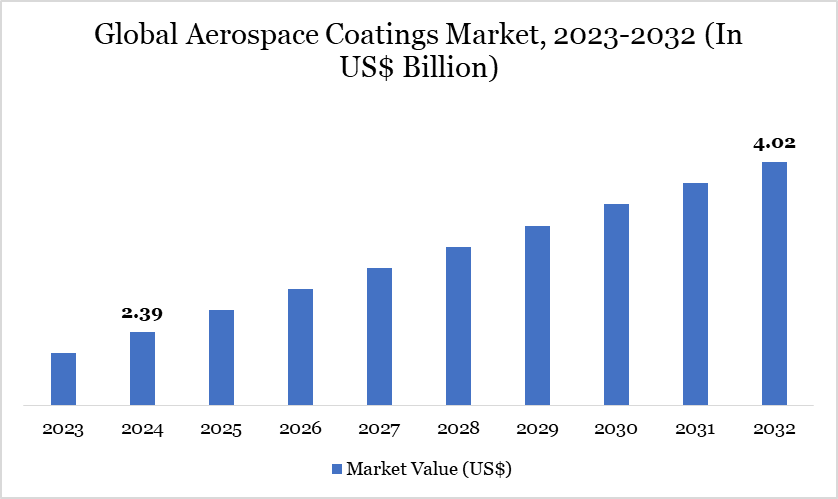

Aerospace Coatings market reached US$ 2.39 billion in 2024 and is expected to reach US$ 4.02 billion by 2032, growing with a CAGR of 6.70% during the forecast period 2025-2032.

Aerospace coatings are applied to aircraft surfaces to enhance durability, resist temperature and pressure changes, and protect against UV radiation and corrosion. Growing demand is driven by an aging fleet, rising aircraft deliveries, the shift to eco-friendly coatings, and the need for longer Resin lifespans. Additionally, the use of vibrant liveries increases the need for specialized coatings. Moreover, this is not solely in relation to prior years, which were still influenced by the pandemic and its consequences. Flight radar 24 reports that on July 6, 2023, over 250,000 aircraft were airborne simultaneously, marking a record high.

Furthermore, over 3,800 new orders constitute a new global annual record. Deliveries are exceptionally high, totaling approximately 1,300 aircraft. The industry has demonstrated substantial recovery and is currently in a robust position. Mankiewicz observed that 2022 surpassed pre-pandemic levels, and this favorable trend has persisted into 2023, propelled by product innovation and performance.

Aerospace Coatings Market Trend

The global aerospace coatings market is experiencing significant growth, driven by several key trends. Foremost among these is the industry's shift toward environmentally sustainable coatings, propelled by stringent regulations and a collective commitment to reducing carbon emissions. Manufacturers are increasingly adopting low-VOC, water-based, and chrome-free formulations to meet these environmental standards.

Technological advancements are also shaping the market, with the development of nano-coatings, self-healing, and multifunctional coatings that offer enhanced durability, corrosion resistance, and thermal protection. These innovations not only extend the lifespan of aircraft Resins but also contribute to improved fuel efficiency by reducing weight and drag.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Resin | Epoxy, Polyurethane, Acrylics, Polyester, Others |

| By Technology | Water-based Coatings, Solvent-based Coatings, Powder Coatings, Others |

| By Application | Interior, Exterior |

| By End-User | Original Equipment Manufacturer (OEM), Aftermarket |

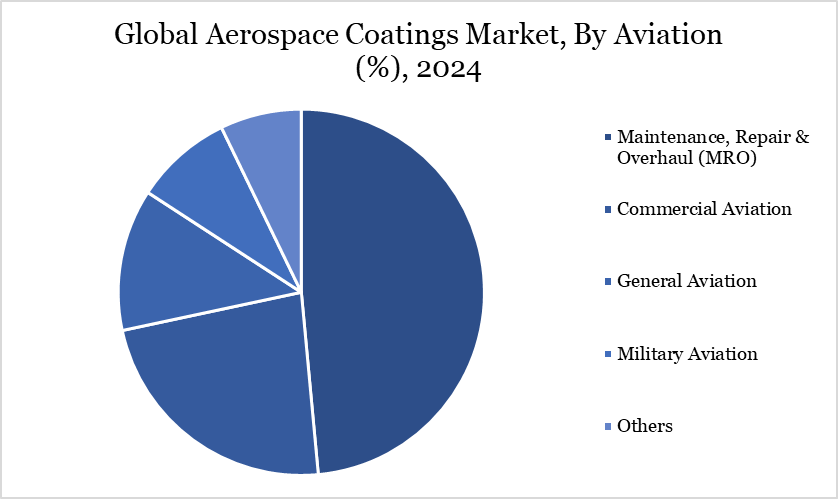

| By Aviation | Maintenance, Repair & Overhaul (MRO), Commercial Aviation, General Aviation, Military Aviation, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Aerospace Coatings Market Dynamics

Growth in Commercial Aviation

The growth in commercial aviation is a major driver for the global aerospace coatings market. As global air passenger traffic continues to rise, airlines are expanding their fleets to meet increasing travel demand, particularly in emerging economies across Asia-Pacific, the Middle East, and Latin America. This surge in aircraft deliveries creates a substantial demand for high-performance coatings that ensure durability, corrosion resistance, and aesthetic appeal.

For instance, in 2023, 35.3 million scheduled commercial flights took place worldwide. Airports handled some 96 million aircraft movements. In 2023, 1,138 airlines operated a fleet of 29,039 commercial aircraft in service, through a route network of several million km. Thus, the expansion of commercial aviation directly contributes to the growing need for innovative, long-lasting aerospace coatings.

Regulatory Hurdles and Raw Material Price Fluctuations

Regulatory hurdles and raw material price fluctuations are significant restraints on the global aerospace coatings market. Stringent environmental regulations, particularly in North America and Europe, have imposed limits on the use of volatile organic compounds (VOCs) and hazardous materials like chromates in coatings.

For instance, REACH regulations in the European Union and EPA standards in the US have led to the gradual phase-out of certain high-performance but environmentally harmful chemicals, compelling manufacturers to invest in research for sustainable alternatives. Together, these regulatory and economic pressures limit the ability of companies to scale production efficiently, posing a constraint on overall market growth.

Aerospace Coatings Market Segment Analysis

The global aerospace coatings market is segmented based on resin, technology, application, end-user, aviation and region.

Rising Significance of MRO Services in Driving Aerospace Coatings Demand

The MRO segment plays a crucial role in driving demand in the global aerospace coatings market. As many aircraft fleets around the world age, airlines and defense operators are increasingly focusing on extending the operational life of their assets through regular maintenance and refurbishment. Coatings are essential in MRO activities for protecting aircraft surfaces from corrosion, UV radiation, and environmental wear, thereby maintaining airworthiness and performance standards.

For instance, in 2025, Trax, a leading global provider of paperless aviation maintenance and engineering software products, announced it will enable the fully digital maintenance, repair, and overhaul (MRO) platform of SIA Engineering Company’s (SIAEC’s) state-of-the-art heavy maintenance facility in Malaysia. Additionally, in 2025, Thales had started a new avionics maintenance, repair, and overhaul (MRO) facility in India. This initiative aligns with the “Aatmanirbhar Bharat” vision, promoting self-reliance in India’s aviation sector. Thus, the MRO segment significantly supports market growth by ensuring continuous demand for advanced, durable, and efficient aerospace coating solutions.

Aerospace Coatings Market Geographical Share

North America’s Expanding Commercial Aviation and US Military Budget Augmentation

North America led the global market. The expansion of commercial aviation in the US and Canada is driving an increase in the consumption of aerospace coatings in the region. The US constitutes the largest aviation market in North America and possesses one of the most extensive fleet sizes globally. United Airlines and American Airlines own the largest fleet sizes.

In April, President Joe Biden approved a US$ 29 billion augmentation to his proposed national defense budget for FY 2022. It was sanctioned concurrently with an additional US$ 13.6 billion in emergency military and humanitarian assistance for Ukraine in light of the ongoing conflict with Russia. The Federal Aviation Administration estimated that the general aviation fleet in the US reached 204,405 aircraft in 2021. Consequently, facilitating market expansion throughout the predicted duration. Thus, above factors boost the region growth.

Technological Analysis

Technological advancements are significantly shaping the global aerospace coatings market by improving performance, sustainability, and application efficiency. Innovations such as nano-coatings and self-healing coatings are enhancing durability, corrosion resistance, and thermal stability, which are critical for both commercial and military aircraft.

For instance, nano-coatings can create ultra-thin, uniform layers that reduce drag and improve fuel efficiency, while self-healing coatings can automatically repair minor scratches and cracks, reducing maintenance needs and downtime.

Aerospace Coatings Market Major Players

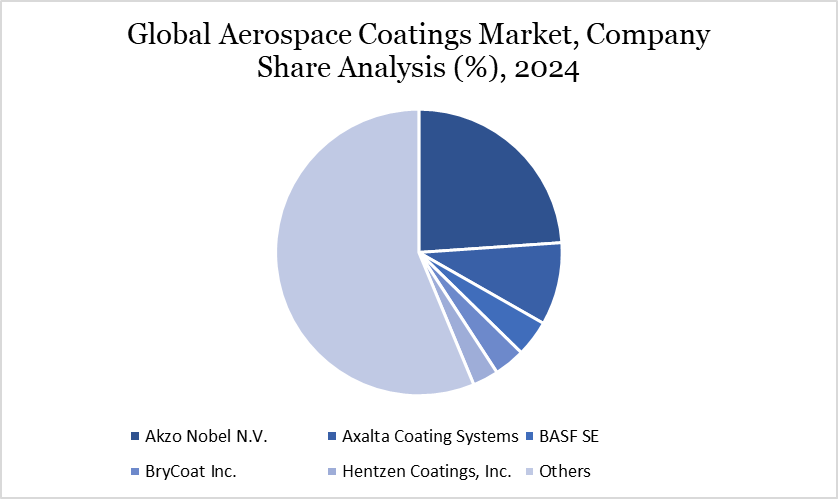

The major global players in the market include Akzo Nobel N.V., Axalta Coating Systems, BASF SE, BryCoat Inc., Hentzen Coatings, Inc., Hohman Plating, IHI Ionbond AG, Mankiewicz Gebr. & Co., PPG Industries, Inc., Socomore, The Sherwin-Williams Company, ZIRCOTEC and among others.

Key Developments

In 2025, the enhanced partnership between IFI and AkzoNobel represents a significant step forward in expanding access to high-performance aerospace coatings for General Aviation OEMs across Europe. This collaboration opens new opportunities, making advanced coating solutions more readily available and supporting the growth of the general aviation sector.

In 2025, International Aerospace Coatings (IAC) has announced plans to build a new state-of-the-art widebody hangar at Rick Husband Amarillo International Airport (AMA) in Texas, USA. The new facility will be situated across the ramp from IAC’s existing five hangars, which accommodate both widebody and narrowbody aircraft. Construction is set to commence in the coming months, with the hangar expected to become operational in the second half of 2026.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies