Are GLP-1s the Next Game-Changer?

How These Drugs Could Revolutionize the MedTech Industry

LP-1 agonists are medications primarily used to manage blood sugar in Type 2 diabetes, with recent success in treating obesity. These drugs mimic the natural GLP-1 hormone, which helps lower blood sugar by stimulating insulin release, blocking glucagon, slowing stomach emptying, and increasing satiety. Available options include Dulaglutide (Trulicity), Exenatide (Byetta), and Semaglutide (Ozempic and Rybelsus). They are often prescribed alongside lifestyle changes when other treatments fail. Semaglutide and high-dose Liraglutide are FDA-approved for weight loss in obesity (BMI ≥30). Though not approved for Type 1 diabetes, some studies suggest they may offer benefits for weight and blood sugar control in Type 1 patients.

Source: Alzheimer’s Association, American Diabetes Association, American Heart Association, Centers for Disease Control and Prevention, Journal of Cardiac Failure, National Council on Aging, National Institute of Diabetes & Digestive & Kidney Diseases, World Obesity Federation

According to DataM estimates, global GLP-1 sales could reach $190 billion by 2032, with a 17.9% compound annual growth rate (CAGR). Currently, Novo Nordisk and Eli Lilly dominate the market, holding nearly 100% of the share, though competitive entrants are expected to capture up to 15% by 2032. Novo and Lilly are poised for significant long-term growth, driven by promising pipeline drugs currently in Phase 3 testing, with double-digit revenue growth expected through at least 2028.

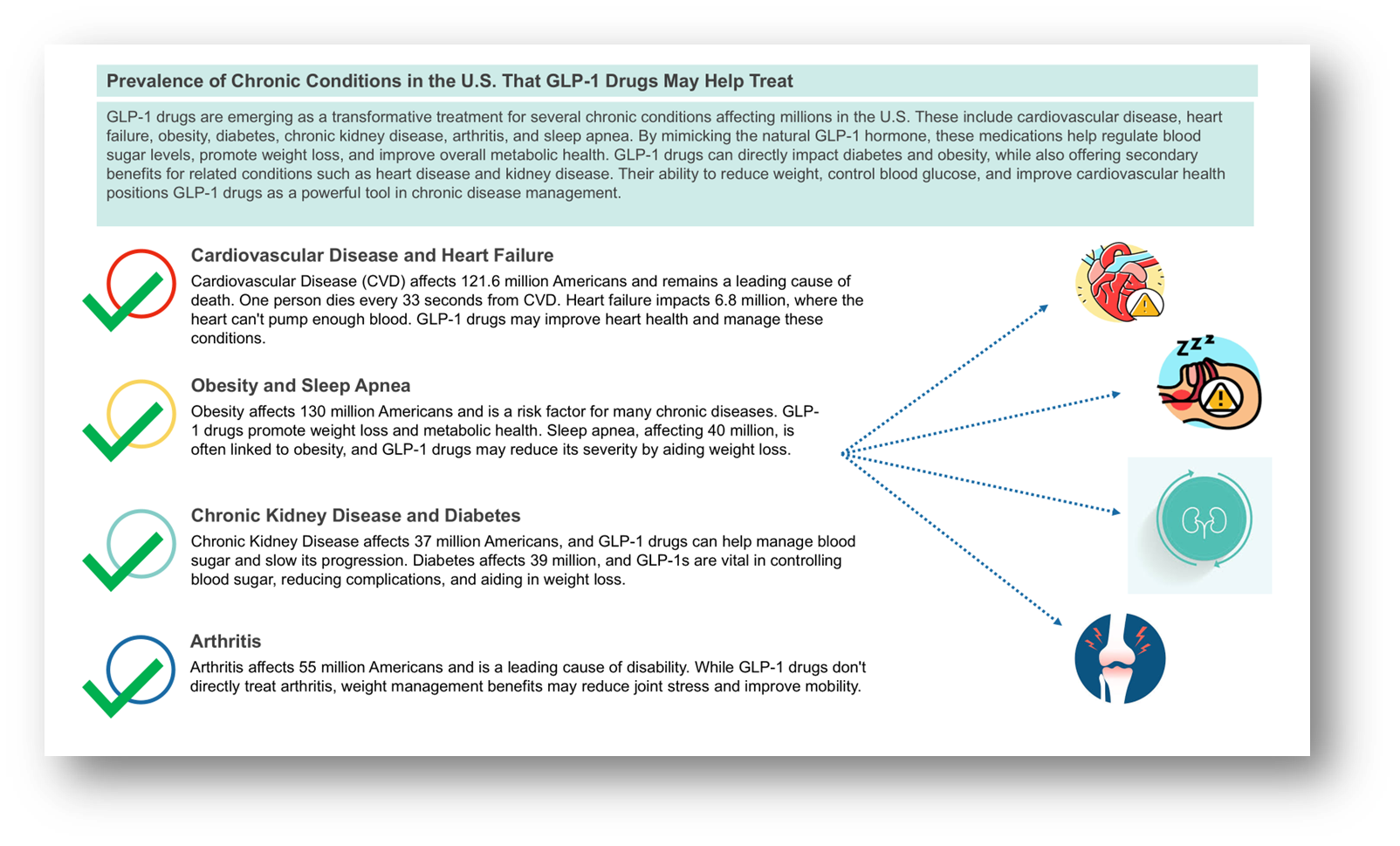

The massive potential of GLP-1s extends beyond just diabetes and obesity, with ongoing trials exploring their efficacy in treating cardiovascular disease, chronic kidney disease, and other serious conditions. If these trials deliver strong results, the market could experience far larger growth than currently projected, especially considering the global burden of cardiovascular diseases and kidney-related conditions. Additionally, as the market expands, it will also drive demand for related medical devices, including drug delivery systems and diagnostic tools, offering growth opportunities for companies like Thermo Fisher, which provides analytical instruments and solutions that support these advancements.

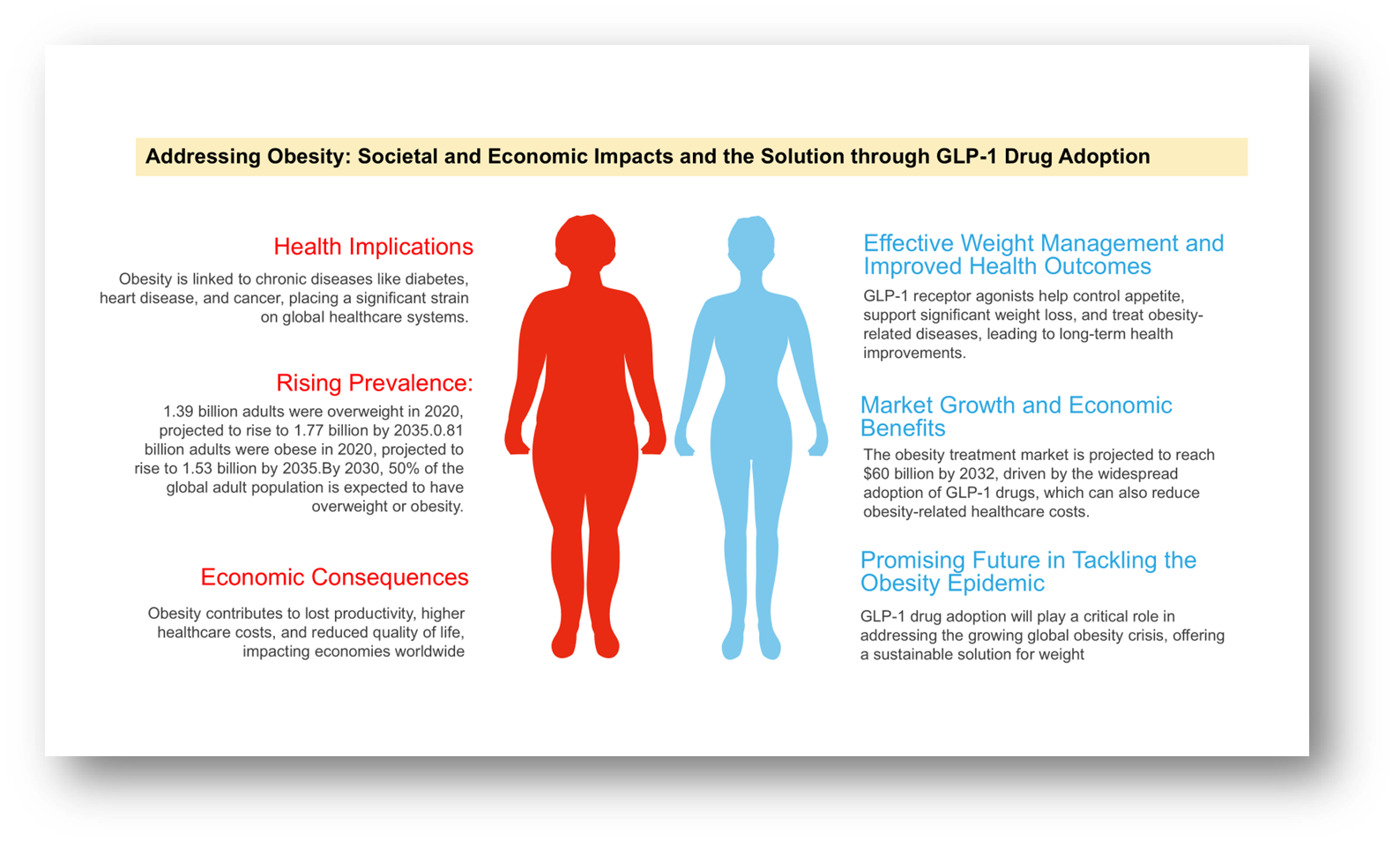

Obesity: A Growing Health Crisis with Far-Reaching Economic Impacts

The global market for obesity treatments is projected to reach $60 billion by 2032, driven by increasing demand for effective weight management solutions. The rise in obesity-related health conditions such as diabetes, heart disease, and hypertension has accelerated the need for innovative treatments. GLP-1 receptor agonists, which help control appetite and promote weight loss, are expected to play a significant role in this growth. With growing awareness and the adoption of such treatments, the market offers substantial growth opportunities for pharmaceutical compasnies, as more individuals seek to manage their weight and improve overall health.

Global estimate (2020) and projected number of adults (2025-2035) with high BM

| Year | Adults with Overweight (BMI ≥25 to 30 kg/m²) | Adults with Obesity (BMI ≥30 kg/m²) | Adults with Overweight or Obesity as a Proportion of All Adults Globally |

| 2020 | 1.39 billion | 0.81 billion | 42% |

| 2025 | 1.52 billion | 1.01 billion | 46% |

| 2030 | 1.65 billion | 1.25 billion | 50% |

| 2035 | 1.77 billion | 1.53 billion | 54% |

Source: World Obesity Federation, 2023b

Top 20 countries for the highest proportion of adult men and women living with high BMI 2020

| Proportion of Men with High BMI | Proportion of Women with High BMI |

| Tonga 80% | Tonga 87% |

| Samoa 79% | Samoa 86% |

| United States 79% | Kuwait 79% |

| Malta 78% | Jordan 78% |

| Kuwait 77% | Saudi Arabia 78% |

| New Zealand 76% | Qatar 77% |

| Australia 76% | Turkey 76% |

| Israel 76% | Libya 75% |

| Qatar 76% | Lebanon 75% |

| Canada 76% | Oman 74% |

| Saudi Arabia 75% | United Arab Emirates 74% |

| Spain 74% | Egypt 74% |

| United Kingdom 74% | Bahamas 73% |

| Jordan 74% | Fiji 73% |

| Czechia 74% | Iraq 73% |

| Greece 74% | Algeria 73% |

| Bulgaria 73% | Tunisia 72% |

| Lebanon 73% | Bahrain 72% |

| Iceland 73% | Iran 72% |

| Montenegro 73% | Mexico 71% |

Source: World Obesity Federation, 2023b

Japan's Approval of Semaglutide and the Growing GLP-1 Opportunity

In November 2023, Japan became the first Asian country to approve semaglutide (brand name Wegovy), a glucagon-like peptide-1 (GLP-1) receptor agonist, for chronic weight management. This approval is a significant step in addressing the global obesity crisis, particularly in Asia, where countries like China are expected to follow suit soon. The introduction of GLP-1 treatments like semaglutide opens up a unique opportunity for Japan to address its growing health concerns related to obesity and metabolic diseases, though with strict prescription guidelines that make it a unique case in the region.

Starting in February 2024, Wegovy will be covered under Japan’s national health insurance, but only under specific conditions. The drug will be available to adults with a BMI of 35 kg/m2 or higher, or those with a BMI of 27 kg/m2 and at least two weight-related comorbidities such as hypertension, hyperlipidemia, or type 2 diabetes. This approach reflects Japan's more cautious stance compared to the U.S. or Europe, where Wegovy is available for patients with a BMI of 30 kg/m2 or higher, or 27 kg/m2 with related health issues. This stringent criterion in Japan presents both challenges and opportunities within the growing GLP-1 market.

While the cost of semaglutide in Japan is significantly lower than in the U.S. and Europe—approximately $87 per month with insurance coverage—there are concerns about limited patient access due to the strict guidelines. The Japanese government has imposed measures to prevent overuse, limiting prescriptions to institutions with qualified medical professionals, such as university hospitals, and requiring patients to undergo six months of dietary therapy and physical activity before receiving the medication. Additionally, prescriptions are initially limited to a two-week supply, which could pose compliance challenges for patients. Despite these limitations, the market opportunity remains substantial, with estimates suggesting that Wegovy’s market in Japan could reach $220 million at its peak, with around 100,000 people being treated.

This regulatory framework also highlights the increasing demand for weight-loss solutions in Japan and the broader Asian market. As the global obesity epidemic worsens, GLP-1 drugs like semaglutide offer promising solutions to manage weight and related diseases such as diabetes and hypertension. Japan’s cautious but optimistic approach to GLP-1 therapies could pave the way for further expansion in the Asian market, where opportunities for companies like Novo Nordisk, which manufactures Wegovy, remain significant.

As Japan and other Asian countries begin to regulate weight-loss medications more carefully, the global landscape for obesity treatment is evolving. The success of semaglutide’s approval in Japan demonstrates the potential for GLP-1 treatments to help manage the obesity crisis. However, patient access and affordability will remain critical considerations, as healthcare systems worldwide balance demand with cost-effective solutions.

Pharmaceutical Industry Moves: Key Approvals, Strategic Investments, and Market Expansions

FDA Approves First Generic of Victoza for Type 2 Diabetes Treatment

The U.S. FDA has approved the first generic version of Victoza (liraglutide injection), a GLP-1 receptor agonist, to improve glycemic control in adults and children aged 10 and older with type 2 diabetes. This approval comes as part of the FDA’s effort to increase access to necessary medications, particularly those in shortage. The generic offers a more affordable option for patients, supporting the FDA’s commitment to providing safe and effective alternatives. This follows the earlier approval of a generic referencing Byetta (exenatide). The FDA continues to prioritize complex generics to enhance patient access.

Lilly’s Zepbound Outperforms Novo Nordisk’s Wegovy in Obesity Treatment

In a landmark clinical trial, Eli Lilly's obesity drug Zepbound demonstrated superior effectiveness compared to Novo Nordisk’s Wegovy. The SURMOUNT-5 study showed that Zepbound helped patients lose an average of 20.2% of their weight over 72 weeks, compared to 13.7% for Wegovy. This translated to a weight loss of 50.3 pounds for those on Zepbound, compared to 33.1 pounds for Wegovy users. Additionally, 32% of Zepbound users achieved a 25% body weight loss, double the 16% seen with Wegovy.

The study, involving 751 overweight or obese participants without diabetes, suggests that Zepbound, a dual-action drug targeting both GLP-1 and GIP hormones, may offer more robust results than Wegovy, which targets only GLP-1. With these results, Lilly aims to reduce Novo’s dominance in the weight loss market, where Novo’s Wegovy and Ozempic generated $6.8 billion in sales in Q3, while Lilly’s Zepbound and Mounjaro earned $4.4 billion. The competition is expected to heat up as more companies, including Viking Therapeutics, enter the market in the coming years.

Merck & Co. Expands GLP-1 Portfolio

Merck & Co. is strengthening its GLP-1 portfolio with a $112 million upfront investment in HS-10535, an oral GLP-1 candidate from Hansoh Pharma. This preclinical drug, aimed at offering cardiometabolic benefits, could unlock significant opportunities in the obesity and diabetes markets, with potential milestone payments of up to $1.9 billion.

Astellas Enhances Gene Therapy Capabilities

Astellas has entered into a $20 million upfront deal with Sangamo Therapeutics to advance neurological gene therapy. This collaboration focuses on using a brain-penetrating adeno-associated virus (AAV) capsid and could lead to milestone payments up to $1.3 billion as Astellas explores further neurological targets.

Betta Pharma’s ALK Inhibitor Receives FDA Approval

Betta Pharma’s Ensacove (ensartinib), an ALK inhibitor for ALK-positive non-small cell lung cancer, has gained FDA approval. It is the first lung cancer treatment developed by a Chinese company to reach the global market, competing with drugs from industry leaders like Roche, Pfizer, and Novartis.

Mitsubishi Tanabe Attracts Buyout Interest

Mitsubishi Tanabe Pharma is the subject of buyout interest from major firms such as Blackstone, Bain Capital, and Japan Industrial Partners. Valued at $3 billion to $3.5 billion, the company is known for its amyotrophic lateral sclerosis (ALS) drug, Radicava.

BeiGene Secures $150M Deal for Cancer Drug Combo

BeiGene has signed a $150 million deal with CSPC Pharmaceutical Group’s subsidiary to license a MAT2A inhibitor. The drug targets MTAP-deleted solid tumors and will be combined with BeiGene’s PRMT5 inhibitor BGB-58067, continuing the cancer combination strategy pioneered by Amgen and Ideaya.

Candid Therapeutics Expands T-Cell Engager Collaborations

Candid Therapeutics, backed by a $370 million Series A round, is expanding its collaborations to develop T-cell engager antibodies for autoimmune diseases. Two of its new partnerships are with Chinese companies EpimAb and Harbour Biomed’s Nona Biosciences.

BMS Regains China Rights to RayzeBio Liver Cancer Drug

Bristol Myers Squibb (BMS) has regained the China rights to RayzeBio’s ABZ-706, a targeted radioligand therapy for liver cancer, following its $4.1 billion acquisition of RayzeBio. BMS also ended its prior agreement with Ablaze, reinforcing the strategic importance of China to its long-term growth plans.

These strategic moves highlight the continued expansion of key pharmaceutical portfolios, with a focus on oncology, gene therapy, and metabolic diseases like diabetes, while also tapping into the growing importance of global markets, especially in China.